Assessing Hail Risk: Why Insurers Need More Than a Storm Report

With hail losses increasing in recent years, accurately assessing the property risk posed by hail has become crucial. Historically, this assessment relied heavily on general weather data, including storm frequency, seasonal patterns, and historical records of severe weather incidents. This approach lacks the specificity and accuracy needed for granular risk analysis at the property level.

National Oceanic and Atmospheric Administration (NOAA) storm reports have been a staple of this method. These reports provide accounts of weather events across the United States, including hail, and contain information about the time, general location, and approximate hail size of reported storms.

While some insurers have traditionally relied on these reports to evaluate risk, storm reports are not a precise enough method on which to build a robust hail risk strategy.

The Limitations of Storm Reports

A significant limitation of storm reports is the human element involved in these reports. Often, storm data is gathered through public or trained spotter reports, leading to inconsistencies and potential inaccuracies. The subjective nature of human observation, coupled with the varying levels of training and experience among reporters, can affect the quality, accuracy, and reliability of the data for insurers.

Reports are also biased towards more populated areas, leaving less populated regions underreported. Without more representative coverage, these reports do not directly reflect where hail is actually falling.

In terms of granularity, storm reports are typically aggregated over extended periods, such as monthly or yearly averages. This can obscure the short-term, intense, and sporadic nature of hailstorms, which can also lead to a misrepresentation of location-specific hail impacts.

Keys to Success: Domain Expertise and Ground Truth

With storm reports providing subjective, coarse, and uneven data, some may think to use weather station data, but this type of information can also have significant temporal and geographical gaps—especially for hail. Instead, domain expertise and ground truth are critical to understanding the actual impacts of hail storms.

For example, many hail risk solutions detect hail high above the ground, as high as 20,000-30,000 ft in the air. This hail may or may not fall to the ground without melting; even if it does, it may fall some distance away from where it was detected aloft.

Trained meteorologists can interpret this data and evaluate the quality of human-derived reports to assess where hail actually fell. The added layer of expertise is a critical component of piecing together a more accurate picture of past and present hail storm activity and, therefore, a more complete view of hail risk.

Precise, Property-Specific Hail Information

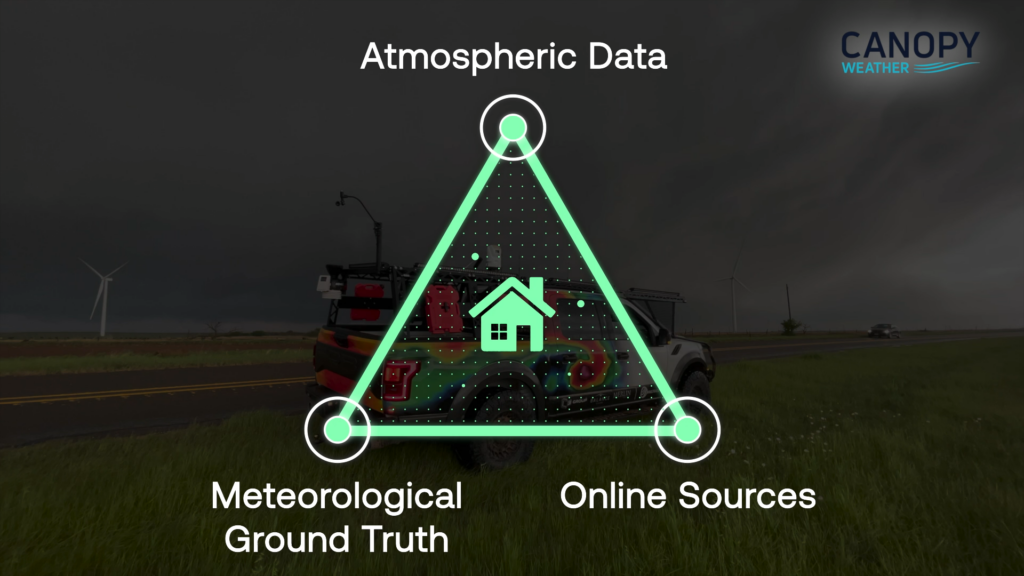

Sophisticated data, like that collected by our partners at Canopy Weather, goes beyond that captured by storm reports. Canopy utilizes several advanced technologies to triangulate a comprehensive and accurate picture of weather events like hailstorms. This method allows for a more objective, detailed, and timely data collection for individual properties.

Central to Canopy’s innovative approach is the utilization of professional meteorologists, which significantly elevates the accuracy and reliability of their weather data. These experts bring a deep understanding of atmospheric science and hail dynamics, enabling Canopy to interpret complex weather data with a level of precision not seen in storm reports.

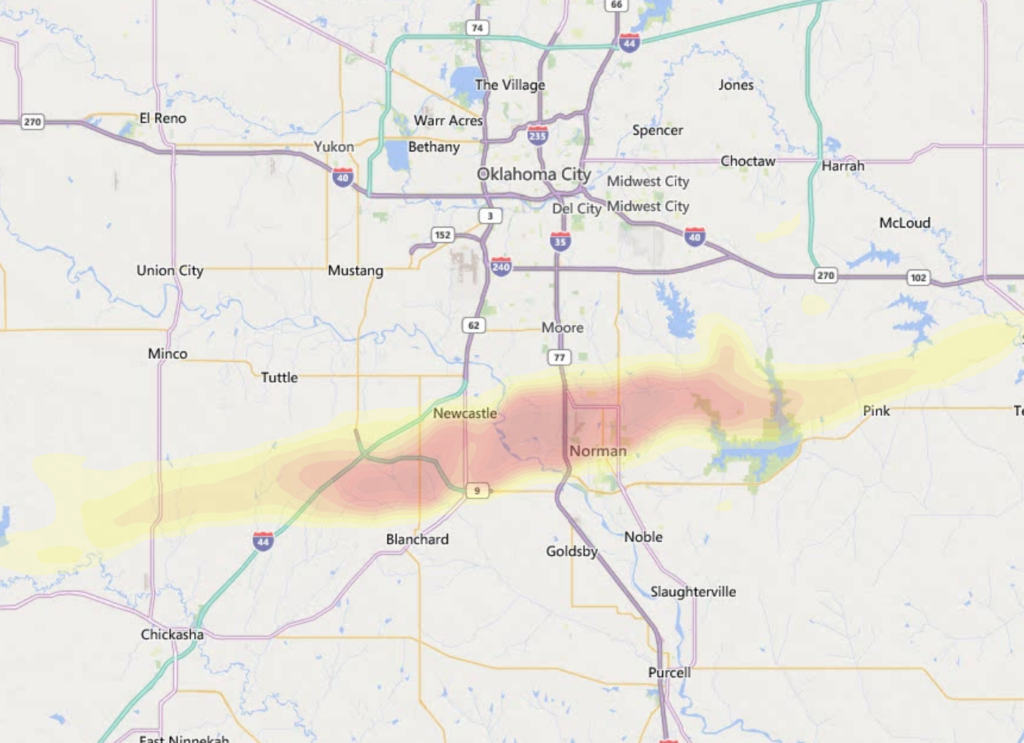

Canopy also tracks and models thunderstorm development in high fidelity, with up to 12 times the granularity of raw radar data. This seamless storm tracking, in combination with additional data sources and expert oversight by their team of meteorologists around the cleanliness of data inputs, provides an unparalleled understanding of each storm and its real-world impacts.

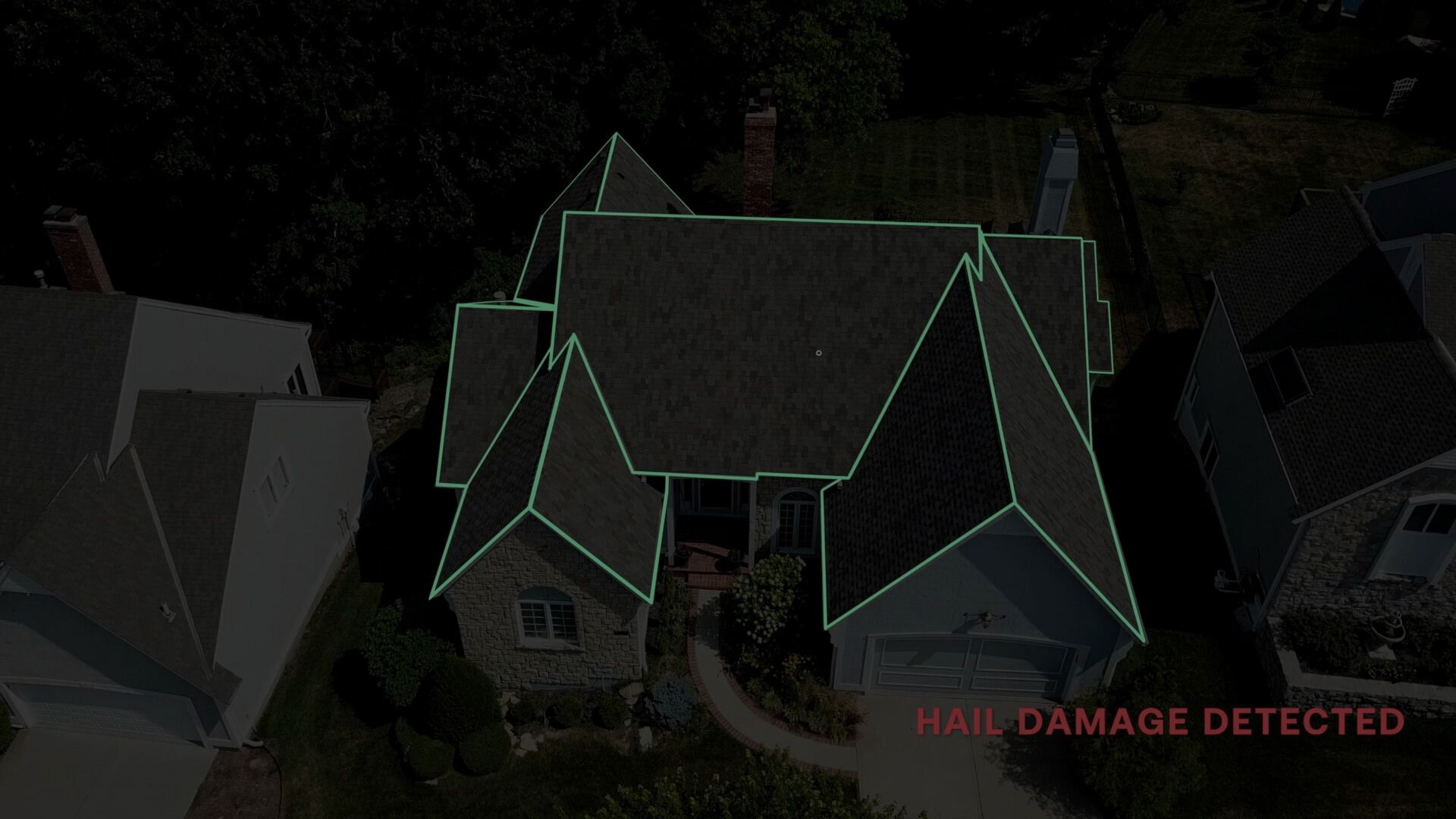

This technology allows users to understand hail impacts at the property level for the very first time, with access to both historical hail information and hail data updated daily.

Why Does This Matter to Insurers?

For insurance carriers and underwriters, integrating advanced and property-specific weather data into CAPE’s property-level hail risk models results in a more reliable assessment of hail risk for individual properties.

Insurers can now have a complete view of the hail risk for a specific property, including its recent hail experience, current structural vulnerability, and future potential loss severity. This enables carriers to make more informed policy pricing and risk management decisions, leading to more accurate underwriting, better customer segmentation, and an improved claims response following hail events.

While storm reports have served as a readily available tool for insurers and other data providers to broadly attempt to assess hail risk, the growing hail claims environment demands better than the current climatological approach. When integrated into CAPE’s risk models, Canopy Weather’s advanced data collection methods offer insurers a more sophisticated, accurate, and actionable understanding of hail risk at the property level.

To learn more about CAPE’s hail risk solution, visit our Hail Intelligence page or contact us today.

This blog post was developed in association with our partners at Canopy Weather.