Home Insurance Property Intelligence

Select the right risks, reduce expenses, and improve customer experience

Deeply predictive insights that help carriers quote, underwrite, rate, and renew home insurance policies more accurately—all in an automated environment.

The geospatial analytics solution relied upon by a majority of U.S. property & casualty carriers

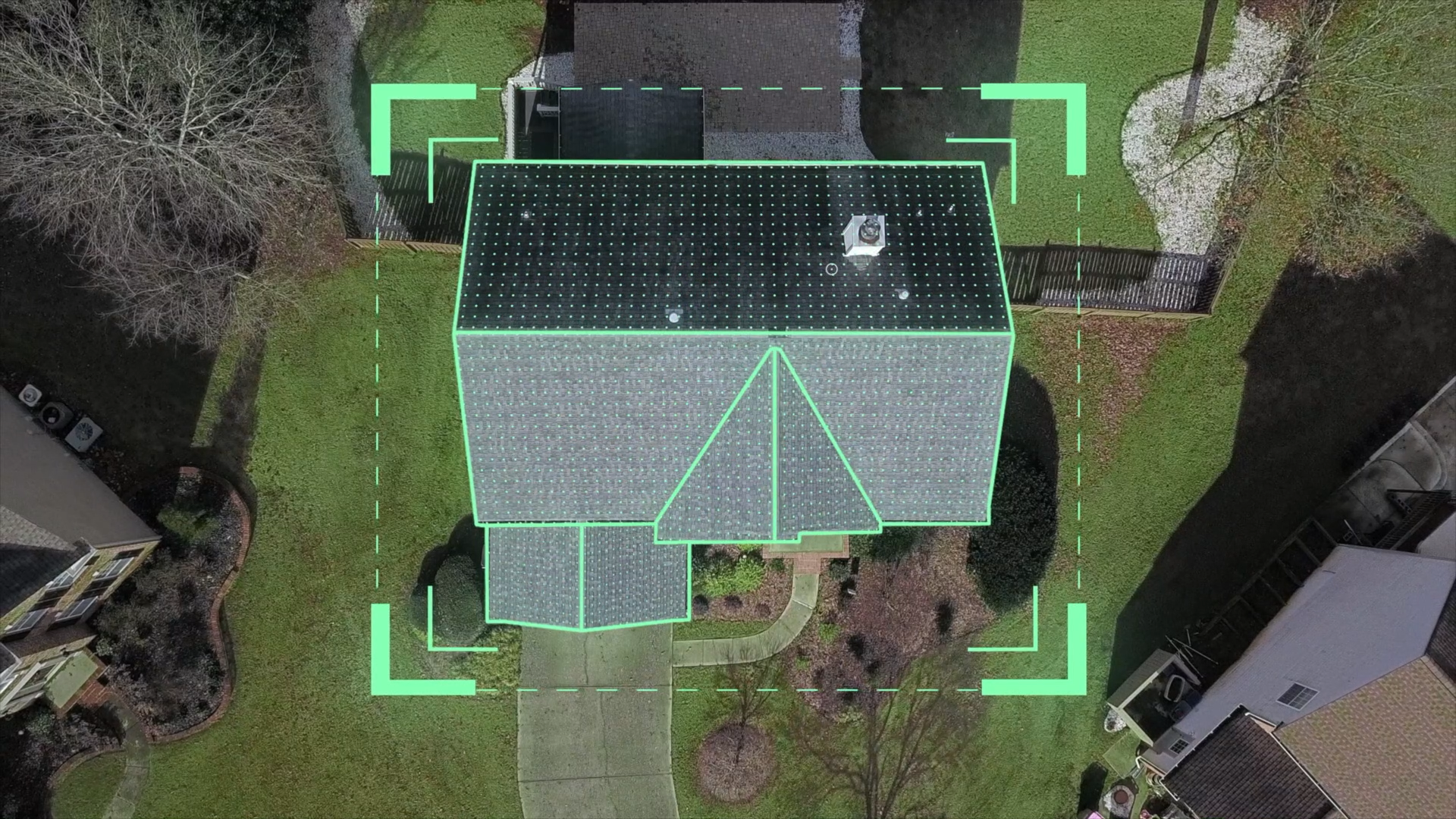

Home Insurance Property Insights are derived from the industry’s most accurate machine learning systems leveraging high-resolution geospatial imagery ↗.

CAPE® home insurance modules include critical risk factors with proven loss-predictive power needed by insurance carriers and MGAs to improve on traditional data sources.

Benefits

Provide instant quotes that more accurately reflect risk. Catch undesirable risks earlier in the funnel. Fast-track desirable risks and mitigate adverse selection. Improve customer and agent experience by providing an accurate quote upfront.

Better direct inspection resources to the homes that need them most, using risk-predictive features, like roof condition or yard debris, as flags.

Accurate pricing and rating lead to improved loss ratios. Segment with greater granularity and identify additional premium opportunities. Develop new rating factors utilizing property conditions.

Put “eyes” on all upcoming renewals using CAPE’s change detection systems ↗ and survey more strategically to improve underwriting costs.

Carousel

Carousel-

“My favorite thing about CAPE is really their people. From the get-go, the CAPE team has been phenomenal. It’s built with insurance professionals, so they understand the issues that we’re trying to solve.”

-

“Using CAPE Analytics is integral to Kin's ability to quickly understand the property at point of application, so we can offer the right coverage and best experience to our customers.”

A Deeper Look at CAPE Home Insurance Insights

CAPE’s Core, Property Condition, Roof Value, and Liability modules inform underwriting workflows with valuable risk data delivered by enterprise-ready, lightning-fast APIs.

Anchored by Roof Condition Rating — the gold standard in roof risk assessment that offers proven predictiveness for claims

Understand holistic property condition with attributes like yard debris and pool condition

Align risk and roof value with attributes like roof complexity and roof size

Detect liability concerns like pools and trampolines upfront

Roof Condition Rating

RCR provides a score on a 5-point scale that indicates the overall condition of the roof and reasons codes that explain why the roof received that score. RCR is used for underwriting (including at quote and for inspection decisions), coverage decisions, and rating. RCR is approved for ratemaking in 39+ U.S. states and is pending in many more.

-

Learn more about RCR

Overview: Roof Condition Rating

CAPE provides

actionable insights

Read The Latest in Residential Property Insights