The Definitive Guide to Roof Condition for Property Insurers

- Introduction

- What Does “Roof Condition” Actually Mean?

- Why is Roof Condition So Important to Property Insurers?

- What Characteristics Point to Increased Roof Claims Risk?

- Why Is Roof Age No Longer Enough on Its Own?

- Why Roof Condition Ratings Are Now Business Critical

- AI From On High: How Roof Condition Ratings Work

- Residential Roof Risk Simplified

- Complex Commercial Roof Assessments On-Demand.

- Roof Condition Key Ingredient in Understanding Weather Risks

- Roof Data Makes The Difference

Why is roof condition such a critical factor for residential and commercial property insurers assessing underwriting risk? In this post, we delve into the importance of roof condition—including top risk factors, why roof age alone fails as a sufficient indicator, and modern, AI-based roof condition rating (RCR) technologies required to understand and price roof risk accurately.

Key Takeaways

- Roof condition, highly predictive of future insured losses, is crucial to assessing coverage eligibility and associated claims risk—and can be a reliable proxy for the state of the underlying structure

- More than 34% of all property claims stem from wind or hail damage to the roof, making information about roof characteristics and condition critical when evaluating residential and commercial properties

- Roof age alone is no longer a sufficient indicator of roof condition—modern, AI-based roof condition ratings are also required to gain a clear understanding of roof condition, remaining lifespan, and risk exposure

- Today’s most robust roof condition rating (RCR) solutions are used by half of the top property insurers in the US and are approved for ratemaking in most states

- These solutions include reason codes and confidence scores that give insurers the ability to become trusted partners to prospects and policyholders to help make a property insurable and reduce claims risk

What Does “Roof Condition” Actually Mean?

In property insurance, roof condition is the term used to describe the state of a property’s roof in assessing coverage eligibility and associated claims risk. Since the roof is a property’s primary protection against the elements, its condition can be a proxy for the state of the underlying structure.

Why is Roof Condition So Important to Property Insurers?

Roof condition directly influences the risk level an insurer takes on when underwriting a property. An old, damaged, or poorly maintained roof can be a recipe for disaster when it comes to claims and payouts. And that matters at a time when insurers face rising CAT losses, stubborn inflation levels, longer claims cycle times, and plummeting customer satisfaction.

Even under “normal” conditions, asphalt shingles and clay tiles that make up the vast majority of all roofs deteriorate over time. But on any given day across the US, more than 120 million roofs on single-family homes, habitational/multi-unit dwellings, and other commercial buildings and facilities are exposed to any of a mix of hazards such as wind, hail, tree fall, extreme temperature swings, fire, and intense direct sunlight.

Today, 34% of all property claims stem from wind or hail damage predominantly impacting the roof. That puts information about the characteristics and condition of the roof at the top of the list when evaluating residential and commercial properties.

What Characteristics Point to Increased Roof Claims Risk?

Specific roof characteristics represent an increased risk for property insurers, including:

- Leaks and Water Damage: Flat or low-slope roofs, or the presence of rooftop equipment, are more prone to water pooling and leakage, which can lead to significant damage.

- Deterioration: Roofing materials, such as wood shingles, tar, and gravel, may be more susceptible to wear and tear. Missing or damaged shingles, sagging, or rot are clear, visible risk factors.

- Defects: Studies have also borne out that visible roof defects caused by natural hazards, aging, or human-related damage indicate an elevated likelihood of future claims.

- Inadequate Drainage: A roof without proper drainage systems can cause water to accumulate and heighten the risk of damage.

These are not small matters to underwriting, rating, and portfolio management strategies that depend on understanding property conditions and risk exposure.

Why Is Roof Age No Longer Enough on Its Own?

Industry claims analyses do demonstrate that older roofs generally perform worse than newer roofs, suggesting that they “correspond with more claims and claims of greater severity.” So, it’s no surprise that roof age has long been a standard input for insurers. It’s also an easy data point to collect from agents and applicants or to source from property record data. Together with roof material and living area, this metric is used by most insurers to make coverage decisions—including whether to underwrite at replacement cost value (RCV) or actual cash value (ACV) for the roof.

But other factors, like property-specific weather conditions, maintenance schedules, and dozens of other more salient data points, give shape to an indisputable reality: Different roofs deteriorate differently or are damaged with varying climate conditions and hazard occurrence rates across the country. In one recent study, for instance, our team compared roof age against industry losses from hail-related claims and found the highest loss ratios were experienced by homes with roofs that were just 6 to 10 years old.

According to Buildfax, as much as two-thirds of all property owner-supplied roof ages are underestimated by more than five years—and more than 20% are underestimated by more than 15 years.

As a result, modern AI-based roof condition rating intelligence is needed to augment roof age and provide a far more complete dataset for gaining a clear read on roof condition, remaining lifespan, and associated claims exposure.

Why Roof Condition Ratings Are Now Business Critical

As many insurers are discovering, new inputs such as AI-based analysis of true roof condition, can help improve risk selection, optimize pricing, and maximize underwriting profitability. This is especially true when you consider that roof condition can be highly indicative of the risk associated with the underlying structure. Total home repair costs for houses with severe roof condition average 250% higher than those with good roof condition, for instance.

That’s why we designed CAPE’s Roof Condition Rating (RCR) solution to classify roof condition objectively and consistently so insurers can get the information they need to accurately understand roof condition on any property in the US—instantly, on-demand. Let’s take a closer look at this technology to get a fuller picture of why this is important.

AI From On High: How Roof Condition Ratings Work

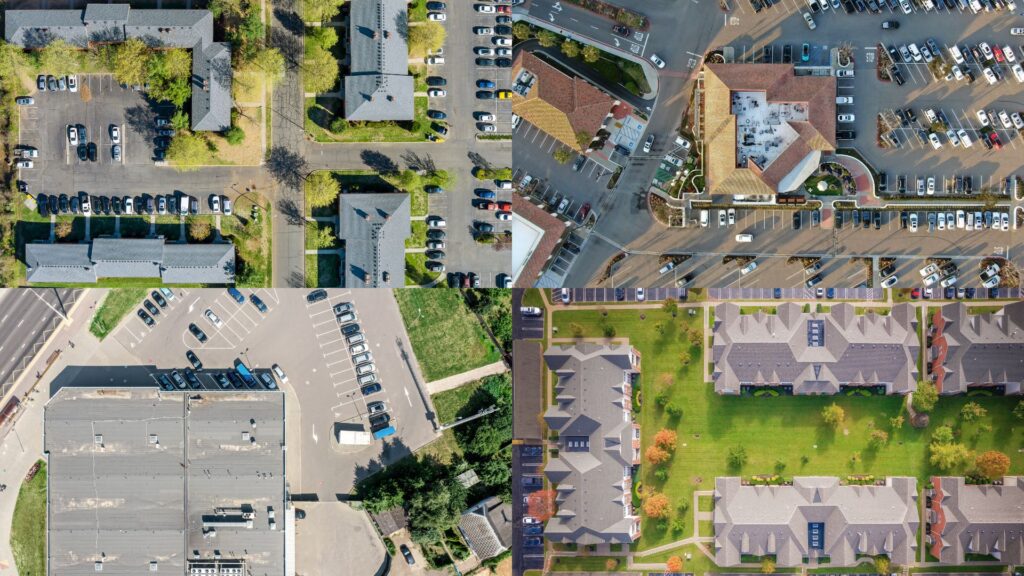

CAPE’s Roof Condition Rating, now in version 5, has proven to be a game-changer in the property insurance industry. It’s used by half of the top property insurers in the U.S. and is approved by state departments of insurance for ratemaking in 40 states—with more coming soon. This predictive, AI-powered solution leverages top-down geospatial imagery (also known as orthogonal imagery) to analyze and classify roof condition on a 5-point scale—Severe, Poor, Fair, Good, and Excellent to indicate the prevalence and severity of any visible roof defects (or lack thereof).

A fixed taxonomy establishes Label definitions. For example:

Severe roofs typically include signs of roof material degradation or the presence of a tarp. Other obvious, major roof defects can also contribute to a Severe rating, such as missing tiles or shingles, or signs of ponding or patching.

Excellent roofs are typically in pristine condition with few, if any, visible staining, repairs, or cosmetic defects.

Across the U.S, Severe or Poor roofs represent roughly 21% of all roofs, while 55% of all roofs are in Good or Excellent condition.

The AI underpinning the latest release of our RCR provides a wide range of data layers and also emphasizes explainability. Insurers now have access to the underlying reason codes for each roof condition score. This enables underwriters to share additional, objective information about the roof with prospective policyholders. Reason codes can include factors such as:

- Tarps

- Ponding

- Patching

- Streaking

- Missing or peeling material

Insurers use these labels for quoting, underwriting eligibility, inspection prioritization, policy renewal, and consumer marketing. RCR is available via lightning-fast API for any of more than 120 million single-family homes and commercial properties across the U.S and Canada. It is calculated throughout the year based on high-resolution aerial imagery—ensuring a clear and recent view of the roof.

Residential Roof Risk Simplified

In real-world implementations, this granular view of their exposure has been shown to help insurers:

- Drive pricing decisions

- Optimize and reduce inspection spend

- Inform eligibility decision

- Assess the current condition of property before renewal

By understanding roof condition at time of quote, for instance, it’s possible to reduce the need for an inspection and the likelihood that the premium will need to be adjusted after the policy is already bound. The ability to understand the condition of any roof also enables insurers to precisely select and prioritize the best risks while avoiding those more likely to result in a future claim.

Complex Commercial Roof Assessments On-Demand.

These and additional use cases aid commercial underwriters, too. For example, CAPE’s Roof Condition Rating for Commercial Lines is built specifically to analyze the number and types of roofs on a property, roof geometry, materials, sizes, and more—both in the aggregate and each individual structure. Designed for small, mid-market, and large habitational properties, our RCR analyzes the complex characteristics of equally complex roofs spanning a variety of sizes, materials, and states of deterioration within the same property.

Our latest release is specially tuned to identify and analyze pitched shingle and tile roofs common in multifamily habitational buildings and to more accurately rate flat membrane roofs that often show signs of discoloration due to dirt accumulation right after a roofing job is completed.

And by leveraging RCR’s reason codes, insurers become partners to insured and prospects by explaining the reasons driving the roof rating and guiding them to mitigation measures that can help make a property insurable and reduce rates (as well as claims frequency) for those already covered.

Roof Condition Key Ingredient in Understanding Weather Risks

Ideally, roof condition intelligence should draw from expansive and continuously updated data. Returning to CAPE once more, we maintain an exposure and loss database provided by insurance carriers consisting of over 20 million exposure records and more than 700,000 location-level claims.

With this kind of data, our roof condition ratings become core ingredients of overall risk, hazard, vulnerability, and mitigation ratings in our wildfire, wind, and hail risk solutions. New weather peril-related solutions developed with the likes of Canopy Weather factor RCR into predicting the likelihood of post-storm damage, a roof’s recent hail experience, and a property’s vulnerability to hail.

At scale, these kinds of data and analytics capabilities enable carriers to enter new markets and refine existing ones by:

- Leveraging property-level risk to cover homes vulnerable to wildfire risk in California and meet new state risk mitigation mandates

- Capture premium, triage inspections, and avoid unexpected loss due to wind peril in coastal states

- Achieve unprecedented segmentation in hail-prone geographies for better underwriting and pricing

Roof Data Makes The Difference

According to McKinsey, insurers employing advanced data analytics technologies can see loss ratios improve up to 5%, premiums rise as much as 15%, and retention of their most profitable segments climb as much as 10% compared to less data-savvy rivals. Roof condition is the cornerstone of property insurance—making access to roof condition data paramount to achieving these kinds of results.

CAPE Roof Condition Rating provides the scale and accuracy needed—and is the only solution to back it all up with confidence scores and reason codes. By leveraging AI, high-res aerial imagery, and geospatial data, carriers can confidently assess and manage risk while property owners enjoy a safer and more secure future.

To learn more about CAPE’s geospatial analytics capabilities and their applications in property insurance, visit this page.