Delivering a New Generation of AI-Powered Commercial Property Intelligence

- Introduction

- CAPE’s AI Revolution Comes to Commercial Lines

- Proven, Loss-Predictive Commercial Property Insights

- Property Mapper: Doing Far More Than Just COPE

- Complex Commercial Roof Assessments Made Easy

- Deeper Property Insights: There’s a (Revamped) App for That

- From Reactive to Proactive Operating Models

- CAPE’s Commitment to Commercial Lines Is Just Getting Started

Artificial intelligence (AI) is powering new advances in commercial property intelligence that will prove business critical to small, habitational, and mid-market commercial property insurers seeking to write more business, improve the customer experience, and provide personalized, proactive coverage.

CAPE’s Commercial Property Intelligence, for instance, provides AI-powered property insights that help leading insurers rapidly accelerate underwriting processes, deliver differentiated value to policyholders—and attain a competitive advantage over rivals.

CAPE’s AI Revolution Comes to Commercial Lines

According to McKinsey, insurers employing advanced data analytics technologies can see loss ratios improve up to 5%, premiums rise as much as 15%, and retention of their most profitable segments climb as much as 10% compared to other companies.

But deploying AI-powered data analytics is no small feat in a sector marked by high policy acquisition costs and the need for a 360-degree understanding of thousands of discrete risk elements associated with multi-structure habitational or other “campus” style properties. Even as property data grows ever-more accessible, the time and resources involved with managing multiple data providers and synthesizing vast amounts of often contradictory data is unrealistic for most commercial carriers

Yet operating without this kind of intel, or drawing the wrong conclusions from it, can lead to excessive exposure when quotes are too low—and premium loss when they’re unnecessarily high.

That’s where CAPE comes in. As the industry leader, our team realized a new approach to commercial property intelligence was needed. One that’s built around ingesting data from a vast array of public and novel sources—and then applying geospatial analytics, computer vision, machine learning, and other AI technologies to transform that data into actionable, up-to-date intel that’s available instantly, on-demand.

Proven, Loss-Predictive Commercial Property Insights

Today, CAPE’s Commercial Property Intelligence provides insurers like The Hartford, Mercury Insurance, and State Auto with accurate, aerial imagery-based property intelligence at submission, with the speed and scale necessary to accelerate the entire underwriting process. This intel includes:

- Current roof condition

- Presence of lot debris

- Weather-related perils

- Plus many other characteristics impacting risk

The proven loss-predictive power of our intel helps carriers improve on traditional data sources for better modeling and stronger results while enabling new product innovations and improving the ease of doing business with agency partners.

Available through API, batch, or using a web application, CAPE’s commercial property intelligence is easily integrated into carrier workflows to give underwriters an unprecedented level of visibility into a wide range of predictive property characteristics for accurate rating and underwriting.

The latest enhancements to our solution further increase the utility of AI-based property intelligence by addressing three unique challenges commercial underwriters face:

Property Mapper: Doing Far More Than Just COPE

Commercial property underwriters have long had to contend with inconsistent policy submissions and the complexity of habitational and multi-structure commercial properties.

Typically, these properties are described by a Statement of Value (SOV) submitted as part of the insurance application. SOVs lack standardization and provide either a single address with a total count of buildings or detailed information for each building with the property.

Today, roughly half of all incoming submissions suffer from variability and inaccuracy—including irregular data with unstandardized or incomplete addresses, bad geocoding, and difficult document types such as emailed spreadsheets, forms, PDFs, or even pictures of a piece of paper.

The inconsistency of SOVs presents a fundamental block to leveraging data and automation in commercial property underwriting. Instead of what should be automated and instantaneous, a human must map the available information in the SOV to a real-world property—a tedious process of matching each building on a property to an appropriate policy.

This can entail underwriters getting tied up for hours looking up imagery from Google Maps, manually geocoding building structures, or hunting through county tax assessor websites for parcel sketches to get a read on risk. Then there’s the task of translating and normalizing the wide range of formats and data received from agents and brokers to get a read on construction, occupancy, protection, and exposure (COPE).

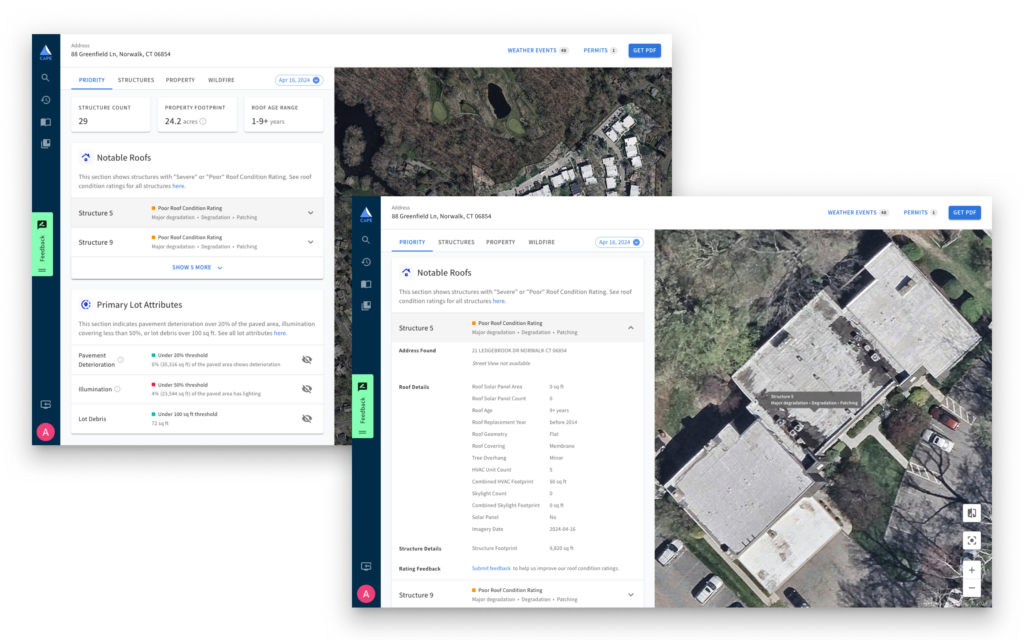

Enter: CAPE Property Mapper. Available within our existing Commercial Property Intelligence, this solution directly delivers the industry’s best COPE data into the appropriate workflows, while supporting human review of exceptions and more complex property types.

With Property Mapper, underwriters enter the address for an apartment complex or other multi-structure property and automatically get an instant view of which building is associated with what policy. From one address or a schedule of multiples, Property Mapper identifies an area of interest on a map containing everything covered under the policy. This capability allows carriers to introduce more automation into the underwriting process.

Complex Commercial Roof Assessments Made Easy

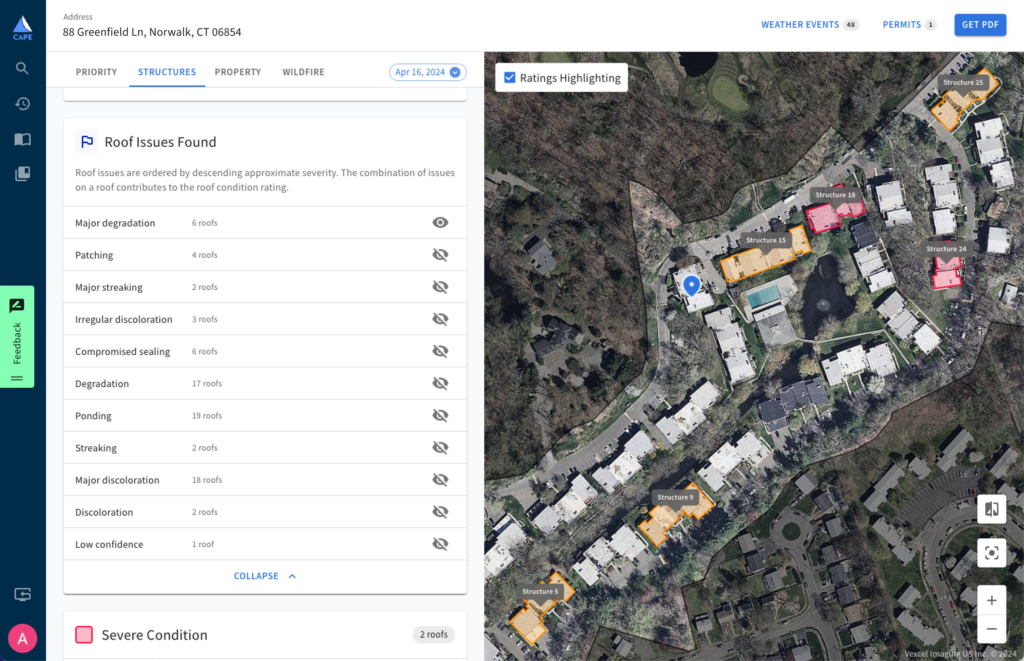

Our industry-leading Roof Condition Rating (RCR) solution leverages high-resolution aerial imagery, computer vision, and other forms of AI to analyze the number and types of roofs on a property, roof geometry, materials, sizes, and more. The latest version of our RCR is specifically optimized for commercial properties, which typically possess structures with complex characteristics and equally complex roofs—spanning a variety of sizes, materials, and states of deterioration within the same property.

Building on a product that’s widely considered the industry benchmark, the latest release of RCR is specially tuned to identify and analyze pitched shingle and tile roofs common in multi-family habitational buildings and to more accurately rate flat membrane roofs that often show signs of discoloration due to dirt accumulation right after the roofing job is completed.

The AI underpinning our new release also amplifies explainability. Carriers now receive reason codes for each roof condition label. Now, underwriters can share additional, objective information about the roof with prospective policyholders. Reason codes can include factors such as:

- Tarps

- Material degradation

- Loose organic matter

- Ponding

- Patching

- And more

This level of transparency and explainability also helps insurers become partners to insured and prospects by guiding them to mitigation measures that can help make a property insurable or reduce rates (and claims frequency) for those already covered.

Deeper Property Insights: There’s a (Revamped) App for That

Commercial property underwriters need the right information, at the right time, at their fingertips to make accurate, efficient risk assessments. That’s why we make our unique, AI-powered property insights accessible in multiple ways that both support automation and manual review when human expertise is required. These methods include lightning-fast API, tailored batch runs, and a web interface.

CAPE’s commercial lines app is purpose-built to bring together Property Mapper, roof condition scoring tailored to commercial properties, and supporting COPE data within an elegant and intuitive web application. Based on client feedback and meticulous prototyping and testing, our newly-redesigned app supports three main goals:

- Surfacing automated, API-fed insights to support and accelerate exception handling

- Streamlining processes to help ensure underwriters don’t get bogged down waiting for answers

- Scrutinizing the most granular data for in-depth verification

With all this in mind, our redesigned application interface is smoother and streamlined, so users don’t have to flip through multiple screens to get what they need. With our new visualization tools, users can easily access a quick overview of a property, or drill down into reason codes or other property features from the image itself by toggling condition overlays on or off.

Meanwhile, our new dynamic mapping tool automatically zooms into a building of interest when a user clicks into structure-specific details. Users can also customize a priority view of a property based on impact eligibility, rate, or other business-specific needs. And our enhanced Property Mapper editing capability makes it easy to fine-tune property boundaries for irregular or complex properties with point-and-click simplicity. All within a streamlined UI that includes prominently-featured “roof issues” panel and intuitive, expandable rows that make accessing detailed, structure-level data easy.

With these and many other updates, our redesigned commercial property web application makes it easier for underwriters to optimize their operations, drive better, faster decision-making, and maximize profitability.

From Reactive to Proactive Operating Models

As if the benefits of leveraging category-leading AI to streamline and automate underwriting processes to win more business and boost operational efficiency and profits weren’t enough, there are other considerations to be made.

That’s because CAPE’s AI-powered solution enables commercial lines insurers to move from responsive to preventative underwriting models that improve outcomes for both the insured and insurer through loss prevention, loss mitigation, and ultimately lower insurance costs. This way, insurers can move from risk transfer partners to true, trusted risk management partners.

CAPE’s Commitment to Commercial Lines Is Just Getting Started

Adding to that last note, it’s clear that new sources of data, and the ability to apply it through AI, will increasingly become a significant differentiating source of insight and value for commercial property underwriters.

In CAPE’s case, our AI-powered Commercial Property Intelligence is giving insurers the ability to transform their operations and launch compelling new products and services that make the business world more insurable. As the AI revolution continues, those harnessing the power of AI-powered solutions are likely to have advantages over those that don’t. As technology and the world of commercial insurance continue to evolve, you can count on CAPE to be at the forefront of exciting new innovations.

To learn more about AI in commercial property underwriting can help insurers select better risks, reduce expenses, and improve the customer experience, request a demo today.

Aggregate Statistics Created Using Data Produced from Nearmap Imagery