What Is Property Intelligence & How Can It Be Used to Measure Valuation and Risk?

Learn How Real Estate Stakeholders, Financial Institutions, and Insurance Carriers Can Assess Property Attributes Remotely Using Property Intelligence Data and Platforms

Are you curious about what property intelligence can do to help your company more accurately assess both property valuation and risk? In this post, we’ll explain what property intelligence is, how it works, and how you can use it to make faster, more accurate financial decisions.

What is Property Intelligence?

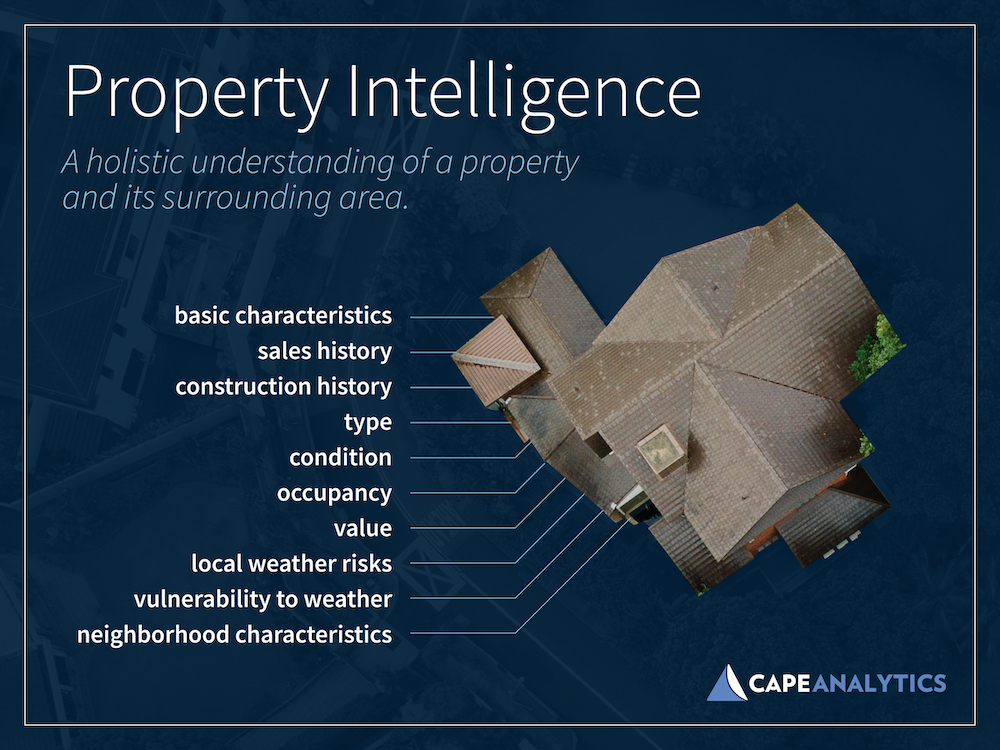

Modern property intelligence can be defined as actionable analytics and information about a property (or set of properties), derived from geospatial data, property records, building information, and additional metadata—analyzed at scale using machine learning and made available on-demand.

Modern property intelligence analyzes individual buildings in-depth, is continuously updated, and can be aggregated for trend analysis. Information includes basic property information like parcel and building size, the type of property, how it is built, and its condition, in addition to other information like previous sales information, valuation, construction and permit history, occupancy, weather risk, and building vulnerability, and neighborhood characteristics that influence risk or value. This same intelligence can be used to gain insight for neighborhood, citywide, and regional trends, including emerging property conditions, new construction and development, changing climate conditions and risks, and more.

In this post, we’ll explore how property intelligence is applied today by businesses in a few key verticals…

Property Intelligence Data for Valuation & Risk

Available through property intelligence platforms via API, property intelligence data is leveraged in a wide variety of applications and is particularly valuable to organizations that transact, manage, trade, service or insure residential and commercial properties based on an accurate understanding of valuation and risk.

Generally speaking, today’s most advanced property intelligence platforms leverage computer vision neural networks that translate geospatial data from high-resolution aerial imagery to establish a “ground truth” about individual properties. These platforms then apply big data analytics to augment this intel with data from a wide-array of other sources to facilitate and deliver robust property analysis (for more on geospatial analytics, read our guide to geospatial analytics-based property intelligence). This information is used by businesses in real estate, finance, insurance and other industries across a variety of use cases, including the following.

Real Estate & REITs

Property intelligence is rapidly gaining traction throughout the real estate ecosystem, where a high-fidelity understanding of property condition, risk, and value is critically important to transaction decisions—and where alternative sources of information are often incomplete or out of date. In an environment marked by low inventories and sky-high prices, 40% of mortgages are now completed with appraisal waivers. The fact is, broker price opinions (BPOs) can be costly and time-consuming. And the notes and curbside images they employ can miss up to 60% of exterior condition issues—including those involving the roof or backyard.

Neural network-based property intelligence makes it possible to quickly and accurately identify critical details such as roof condition, driveway cracks, landscaping, yard debris and dozens of other property attributes that can directly impact valuation and risk. These can be analyzed with hundreds of additional data sources using machine learning, to then create higher-value insights. When used to augment automated valuation models (AVMs), for example, this intelligence can mean the difference between success and potentially ruinous financial decisions.

While agents and brokerages can use this intelligence to assess value and negotiate prices, this level of insight is of particular interest to iBuyers and single-family rental (SFR) investors, who now purchase up to thousands of properties per month. Whether they’re exploring a single property, or shopping citywide, regionally, or even nationally, accurate, on-demand property intelligence enables these investors to zero in on promising properties and avoid risky ones. They can also assess aggregate changes at the neighborhood, zip code or CBSA level to unearth trends that may be otherwise impossible to identify.

The same is true for real estate investment trusts (REITs) and other organizations managing real estate portfolios across multiple properties or regions. For these businesses, access to accurate property intelligence represents a strategic advantage in not only acquiring new properties and other real estate-based investments, but also in determining when and where it might be a good time to sell.

Property & Casualty Insurance

By providing insight on current property conditions, risk, and value, property intelligence gives insurers the ability to accurately assess risk when offering online quotes to customers shopping for homeowners insurance online. Because geospatial data can be used to detect debris, pools, trampolines and dense vegetation, it can give insurers an edge in underwriting, claims processing and triaging, risk control, and more.

At a time when 40% of insurance claims are related to the roof and homes in very high fire hazard zones with heavy vegetation have 5X the risk of those with defensible space, easily-accessible intel on property characteristics is critical. The same is true in commercial property insurance, where attributes like roof and parking lot condition are directly correlated to weather-related losses, business interruption and workers comp claims.

And don’t forget renewals. After a property is underwritten, it isn’t reinspected for years, leaving many reinsurers to leave fundamental risk factors out of their analysis of cedant portfolios. By incorporating timely property intelligence data into renewal workflows, insurers also reduce inspections of properties known to be high-quality, provide more accurate pricing at renewal, mitigate future losses, and right-size coverage based on changing property conditions over time.

Finance

Property intelligence enables loan traders, originators and servicers to make split-second transaction decisions and optimize or expedite the property inspection process. The business value of this data is especially pronounced in distressed or whole loan trading.

Using property intelligence data, loan traders can identify outlier properties and quickly determine whether target properties are in good condition, as well as flag potentially risky investments and determine the potential rehab costs. According to recent studies, overlooked condition issues can significantly impact marketability and miss estimated rehab costs by up to 250%, according to a recent property intelligence overview from HousingWire.

They can also monitor existing positions and quickly understand if there are important changes to property condition that may affect collateral value. This can include the condition of the roof, or the addition of a pool, solar panels, the number of structures on the property, and more.

Property-Related Service Businesses

Though it’s still early days, look for roofing, solar panel installation companies, landscape management companies, and others to increasingly leverage intelligence on roof condition and other property attributes to conduct remote inspections for prospecting and quoting. Local governments can conduct property tax assessments far more efficiently. Telecoms and other utility companies can identify towers at risk from vegetation overgrowth to manage clearance operations.

How CAPE Analytics Property Intelligence Powers Better, Faster Business Decisions

The business value of AI-enabled property intelligence described in this post is far from hypothetical. At CAPE Analytics, for instance, our property intelligence platform delivers valuable intel on more than 110 million properties nationwide—instantly and at scale, and with a level of detail that otherwise requires on-site inspection. All available via API and easily integrated with existing business workflows.

Today, our property intelligence data is used to dramatically enhance traditional data sources used by stakeholders in the real estate sector. AVMs powered by CAPE property data, for instance, have been shown to generate valuations that are 7.7% more accurate than standard approaches, and helps iBuyers, loan traders, originators and others achieve a median discount of 10% on off-market properties compared to peers.

This same granular property intelligence is proven to predict property loss and risk in the insurance space, and has become a cornerstone of the underwriting process for more than 50 insurance carriers. That includes State Auto, Hippo, The Hartford, CSAA and others who leverage our property intelligence to reduce the need for property inspections, provide more accurate pricing at underwriting and renewal, and mitigate risk by helping policyholders proactively repair damaged roofs, cut back vegetation, and much more.

To learn more about how property intelligence from CAPE can help you measure value and risk to make better, faster business decisions and reduce operational expenses, request a demo now

Aggregate Statistics Created Using Data Produced from Nearmap Imagery