What Are the Current Valuation Methods and Turn Times for Credit Union Lending?

Credit unions, known for their member-centric approach, offer a range of mortgage products known for their competitive rates and personalized service. When it comes to valuation methods for home equity lending, credit unions can employ a spectrum of traditional appraisal techniques like in-person inspections or advanced analytical tools like automated valuation models (AVMs) to accurately assess property values.

CAPE recently conducted a survey of credit unions, ranging in size from 15,000 to 450,000 members, to understand the home equity valuation methodologies and turn times seen in the market today. The average membership of those surveyed was about 118,000 members. Below are the findings on the current state of valuation in the credit union lending process.

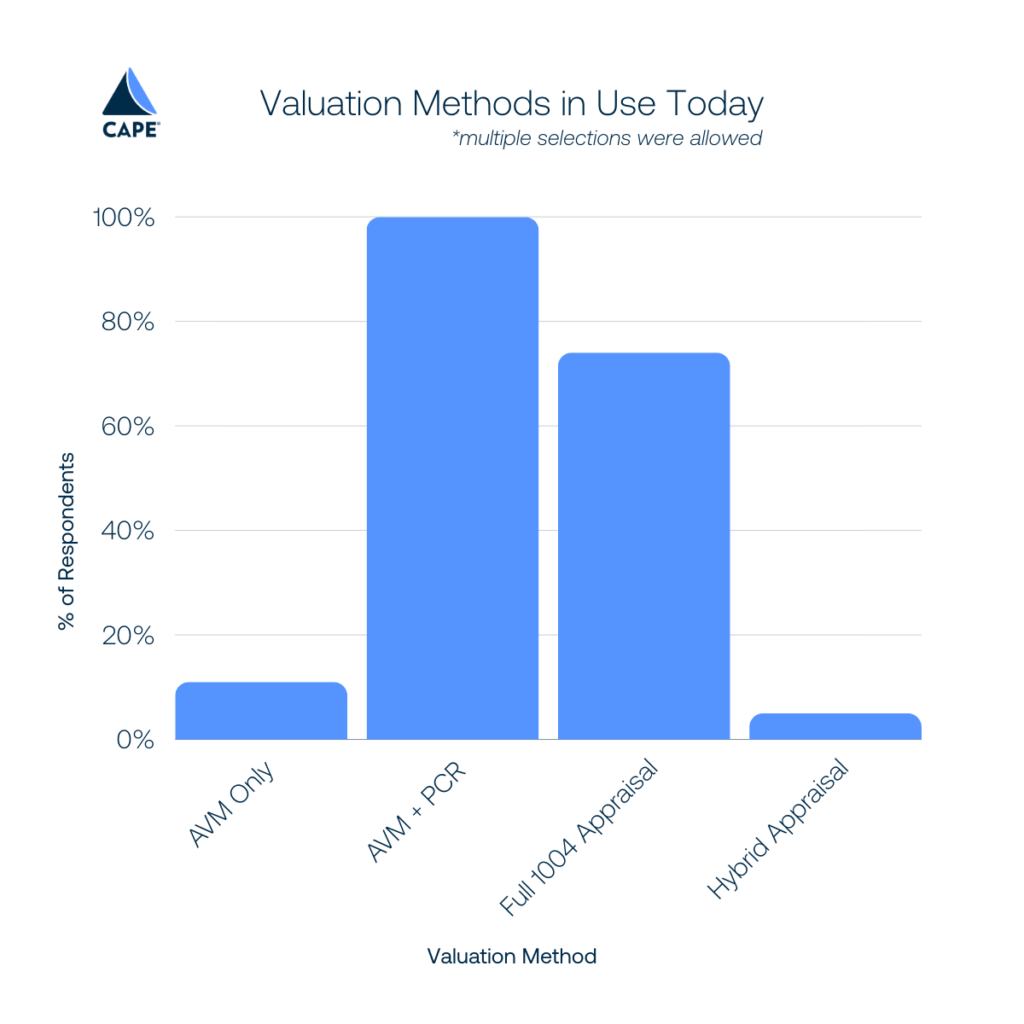

Of the credit unions surveyed, 11% use an AVM only, 100% use both AVM and property condition report (PCR), 74% use a full 1004 appraisal, and 5% use a hybrid appraisal. As is evident by the total exceeding 100%, respondents were able to choose the multiple methods that they use in their processes. The most widely used methods by far are the combination of AVM and PCR and the full 1004 appraisal, with every credit union surveyed using the AVM and PCR combination.

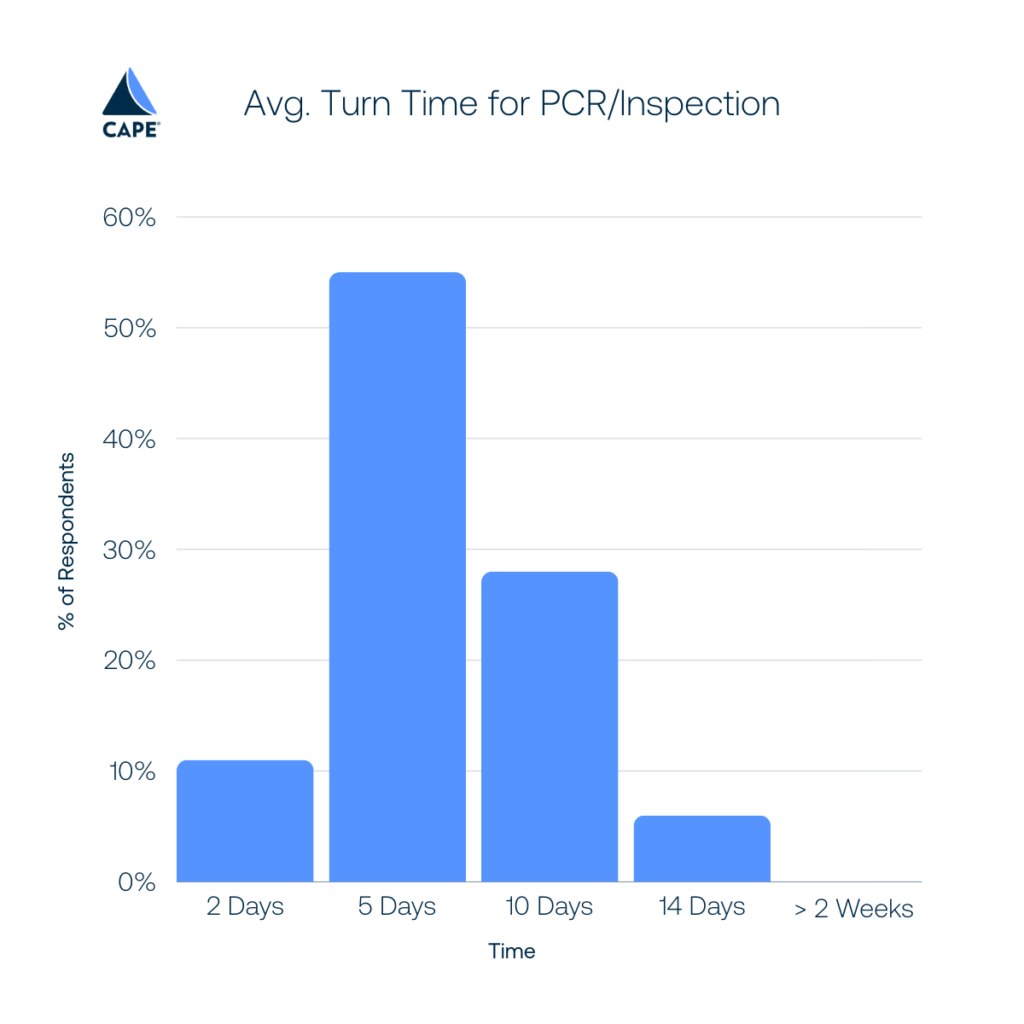

The second question in our survey asked credit unions their average turn time for the PCR/inspection part of their valuation process. 11% of respondents said 2 days, 55% said 5 days, 28% said 10 days, 6% said 14 days, and no respondents said that their turn time was over 2 weeks. From these results, it’s safe to say that the average turn time for these credit unions is 5 to 10 days, with a majority of those skewing toward the 5-day mark.

Still, there remains room for improvement when every hour counts against the competition and the pressure to keep member satisfaction is high. With an in-person PCR or inspection taking at least five days to execute, according to our survey, there is the opportunity to streamline or even eliminate this step in the process to save valuable time for the organization and its members.

An instantly available PCR, like that produced by CAPE, is an objective and efficient way to take days off of the entire process. The automated PCR (aPCR) features instantly accessible property condition insights and is easily integrated into existing valuation workflows to improve decision-making and turn times. By leveraging these kinds of innovative solutions, credit unions can maintain their commitment to providing exceptional member service while ensuring an efficient and fair lending process.

To learn more about how the automated property condition report (aPCR) can shorten turn times, click here.