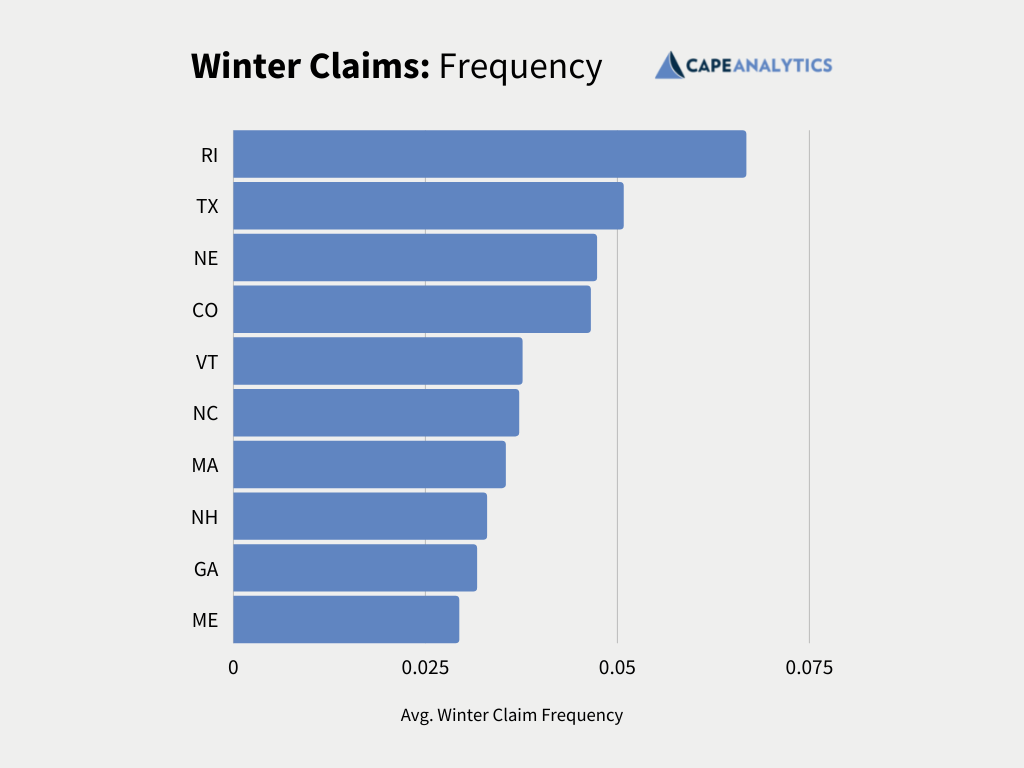

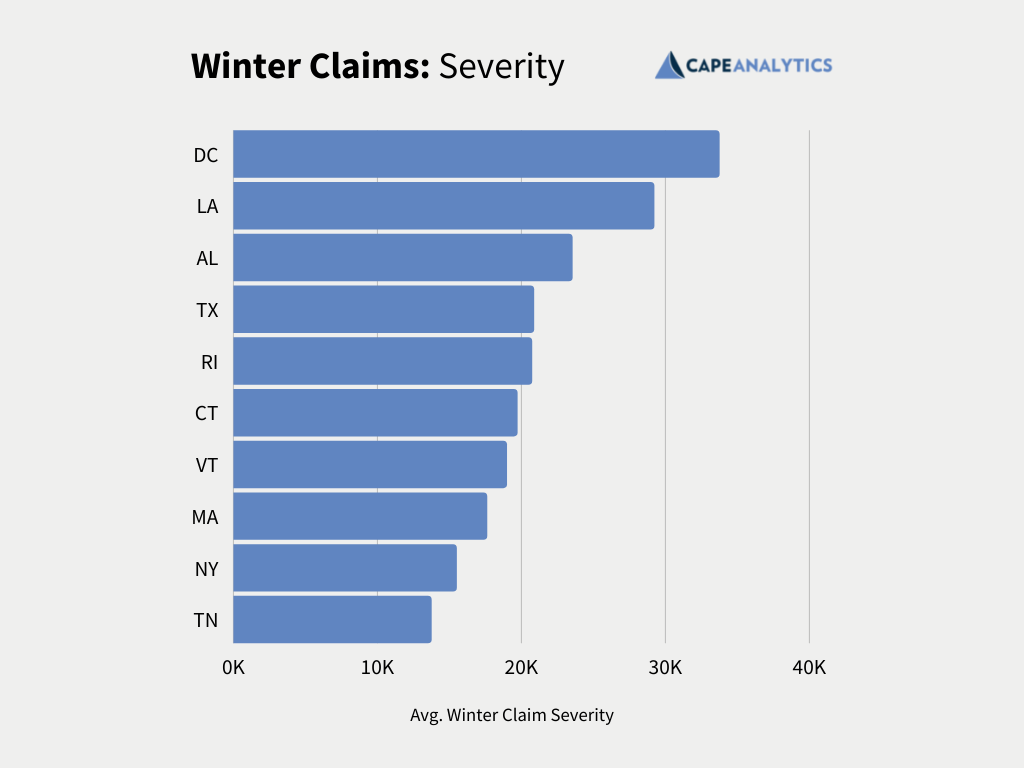

CAPE IDs Top 10 States for Winter Insurance Claims by Frequency & Severity

Nothing like January’s bomb cyclone, following on the heels of a record-warm December 2021, to help explain new data from CAPE Analytics about winter weather damage. This new information details the US states with the highest frequency of homeowners insurance claims during winter months—as well as those with the most costly.

At first glance, the lists may seem as topsy-turvy as our recent weather. Just days into the new year, snow fell hours after wildfires had scorched drought-stricken Colorado. Severe weather as far south as Texas, Arkansas, and Tennessee recalled the historic freeze that resulted in 246 deaths across 77 Texas counties just last winter.

By mid-January, a brutal “Saskatchewan Screamer” had placed 80 million Americans under a winter weather alert, complete with a TV ticker tape of pure chaos: 3,000 canceled flights, 260,000 left without power amid bitter temperatures, tornadoes obliterating mobile homes—in Southwest Florida.

Maybe this is old-fashioned, but seeing Texas rank #2 in a list of states with the highest average frequency of winter homeowner’s claims may seem counterintuitive. Ditto for neighbors like Alabama and Louisiana joining it on a list of states with the costliest. Until you get the bigger picture, that is.

Southern States & Winter Claim Severity

A surprise cold snap can catch many in the US south by surprise, helping to explain the severity of claims in LA, AL, and TX. Folks in northern climes are accustomed to preparing their homes for long, unforgiving winters.

Welcome to the New Weird?

Why would Rhode Island top the list of most frequent winter homeowner’s claims, versus say, Maine (#10)—much less North Dakota or Michigan, which don’t even make the top 29? Why would the District of Columbia rank #1 in severity of claims? And why would three of our most southern states see the costliest average claims?

The charts featured in this post reflect data from more than 20 million claims records contributed by insurers who rely on CAPE’s property intelligence solutions to understand and price property risk accurately. The data does not yet reflect Winter 2021-2022. Instead, they capture figures from 2017 through 2020—a trio of years that may reflect a longtime status quo in need of further analysis; an anomalous block of wacky winter weather; or a harbinger of what’s to come.

The truth may lay in all of the above. Last winter’s Big Freeze, for instance, drove its dagger from the Midwest through the Southeast, to the Mid-Atlantic and Northeast, and deep into the heart of Texas. That alone could skew the score for all three years combined.

According to the Insurance Information Institute, winter storms caused $4 billion in insured losses in 2018; $2 billion in 2019; and $1.1 billion in 2020. But the Polar Vortex that brought prolonged and historic cold and dangerous wind chills to 48 states from February 12 to 22, 2021 caused a record-shattering $15.1 billion in insured losses just by itself.

It remains to be seen if 2022 will bring more of the same. But the fact that the number of extreme weather events that cause $1 billion or more in damage has been climbing at a steady clip in recent years isn’t promising.

… Or Is It Just More of the Usual?

Now consider that the most common winter insurance claims involve frozen and burst pipes; losses from falling trees and limbs; roof and siding damage from heavy snowfall, sleet, hail, and wind; and ice dams, which can form on the edge of your roof—blocking melting snow from falling away in a vicious cycle of build-up that can cause severe water damage inside your home. Throw in fire damage from fireplaces, Christmas lights, space heaters, and other hazards, along with winter-related personal injury liability claims, and you get the fuller picture.

Even in the most mundane years, a surprise cold snap could catch many in the US south by surprise, which can help explain the severity of claims in LA, AL, and TX. Folks in northern climes are accustomed to preparing their homes for long, unforgiving winters, after all.

In terms of claims frequency, Rhode Island figures into most Northeastern winter storms, at least in part explaining its rank at #1 in that category. The state has also been hit hard in 10 of the last 15 costliest winter storms in the last 20 years, and is at higher than average risk from snow, ice, heavy winds, sleet, and freezing temperatures—pointing to reasons behind its #5 ranking for claims severity.

On their own, however, nothing in these particular datasets helps when it comes to understanding the District of Columbia’s #1 ranking in that second category. Perhaps rising perils stemming from severe storms, hurricanes, and snow combined with the high cost of repairing historic homes tell the story behind average winter claims costs of nearly $35,000 versus the national average of $13,582. Maybe sporting the nation’s highest percentage of housing rentals suggests expensive lawsuits play an outsized role in winter claims costs, too.

Whatever the case, time will tell if our nation’s capital (and the rest of us) are in for more of the usual weather this winter—or if what’s “usual” is in for more change than we may realize.

Click here to learn more about weather-related perils and how CAPE Analytics’ AI property intelligence solution can help better segment risk.

Aggregate Statistics Created Using Data Produced from Nearmap Imagery