CAPE Analytics Launches New Wildfire Intelligence Suite for Commercial Properties

The offering makes CAPE the first and only analytics provider to assess wildfire vulnerability for both residential and commercial properties using specifically-tailored products.

Wildfire risk isn’t limited to just single-family homes. With the increasing size and frequency of wildfires, commercial property carriers now find themselves needing to assess this risk in the same way as their home insurance counterparts.

Recent commercial property wildfire losses have been hard to ignore. In 2017, the Tubbs Fire destroyed 94 commercial buildings and damaged 23 more. The Marshall Fire destroyed 7 commercial structures and damaged 30. In terms of a dollar amount, losses from California wildfires alone have caused over $4 billion in commercial losses per year in recent years.

To accurately assess commercial buildings’ vulnerability to wildfire, we’re proud to announce CAPE Wildfire Intelligence for Commercial Property, a holistic risk solution that provides carriers and MGAs with both property-level and structure-level insights.

The Need for a Commercial-Specific Wildfire Risk Solution

While many of the same mitigation measures that are used for residential structures, like maintaining defensible space and reducing vegetative fuel, remain true for commercial lines, commercial properties experience wildfire risk differently. For one, commercial properties are often characterized by their sizeable amount of paved area, which can affect the amount of and locations of vegetative coverage.

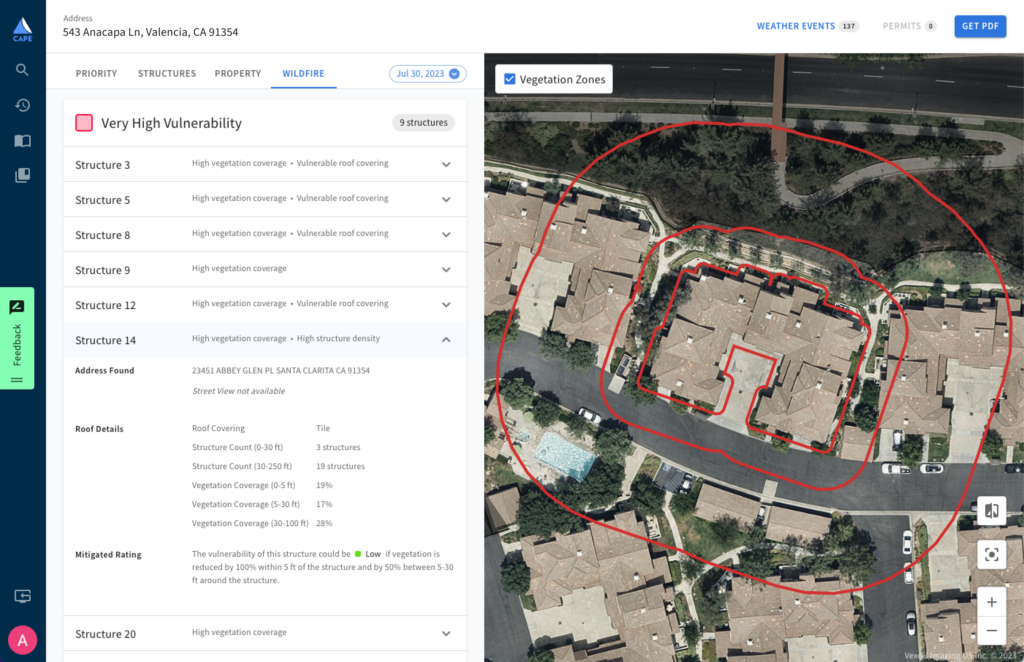

The biggest difference, though, for properties like multi-structure or multi-parcel habitational communities is that understanding a single structure’s wildfire risk profile is only half the battle. In the case of these properties, true understanding of their wildfire risk lies in understanding the risk for its individual structures and the aggregate risk of all its structures.

Building on the power of CAPE’s commercial property intelligence and Property Mapper, which accurately identifies the structures attributed to a policy, CAPE’s new commercial wildfire offering provides the most accurate view of both structure-level and property-level risk insights.

Introducing Wildfire Intelligence for Commercial Property

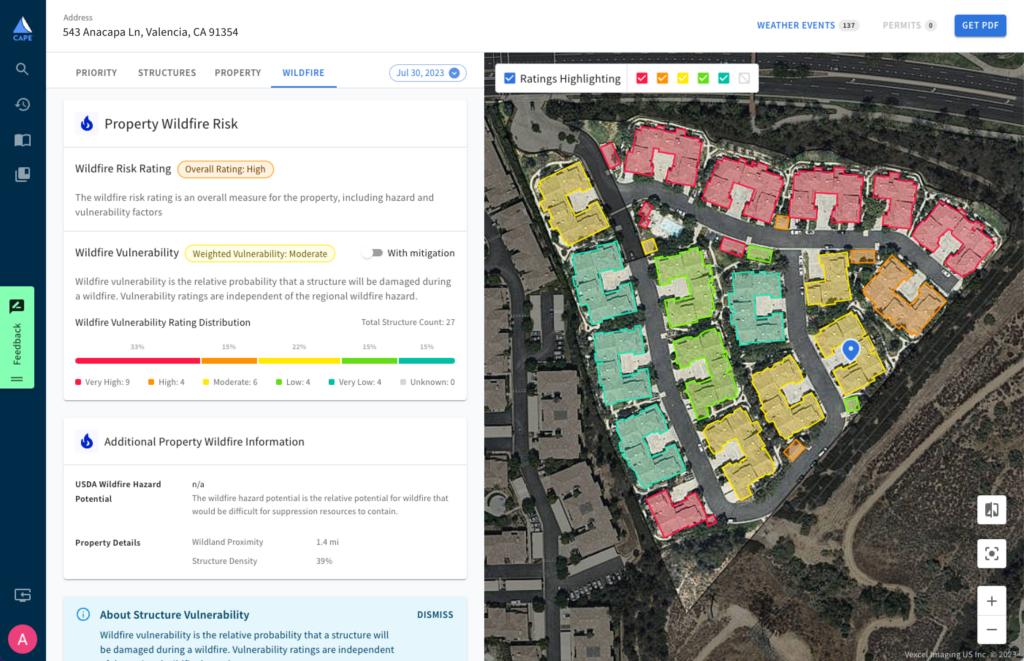

Available via API and our newly redesigned web application, CAPE Wildfire Intelligence for Commercial Property provides both granular and holistic views of wildfire risk through the following scores:

Wildfire Vulnerability Rating: For individual structures, this score is the relative probability that a structure will be damaged during a wildfire. Included with each structure-level rating are the underlying reasons like the amount of nearby vegetation or a high structure density. For multi-structure properties, this score is the aggregate weighted vulnerability score for all of its structures.

Wildfire Mitigation Potential: At the individual structure level, this score represents the Wildfire Vulnerability Rating of a property if all mitigation actions are taken. At the property level, the score is the aggregate weighted mitigation rating across all structures.

Wildfire Risk Rating: Representing the most holistic view of commercial wildfire risk, this rating merges hazard information with all vulnerability factors to give an overall view of a structure or property’s risk.

Taking into account predictive property attributes such as vegetation coverage, wildland proximity, neighboring structure setback, structure density, and more, CAPE Wildfire Intelligence for Commercial Property allows commercial carriers to have a complete view of wildfire risk for small, habitational, and mid-market commercial property underwriting.

Armed with this set of complete wildfire information for the entire property, carriers are also able to become proactive partners in reducing the property’s risk. Insurers working with habitational communities, for instance, can work with the property’s owners or homeowners association (HOA) to take steps to mitigate the community’s wildfire risk.

Commercial Wildfire Intelligence and Beyond

The CAPE Wildfire Intelligence Suite for Commercial Lines is just one of the many recent exciting developments for commercial carriers. Property Mapper, a first-of-its-kind tool for identifying the exact structures from a submission, allows underwriters to gather property risk intelligence at the policy level rather than individual structure—reducing the time and effort it takes for underwriters to understand which structures belong to a property.

Other new innovations include a commercial lines-specific version of CAPE’s gold-standard Roof Condition Rating (RCR) and the aforementioned redesigned web app, which empowers underwriters to make faster, more efficient risk assessments.

Together with these new wildfire insights, CAPE’s commercial property intelligence provides the most holistic view of property risk that helps carriers reduce inspection expenses, avoid unexpected loss, and improve underwriting efficiency.

Want to learn more about how CAPE can help commercial carriers better assess the growing threat of wildfire risk? Reach out to our team here.