New Risk Signals Improve Insight into Roof Claim Potential

Cape Analytics has developed Roof Condition Rating, a new property attribute that identifies exposures with increased potential for roof claims

Underwriting, rating, and portfolio management strategies depend on knowledge of the exposure and its specific property characteristics. Because 45% of all homeowners claims are related to wind or hail damage 1, predominantly impacting the roof of a structure, information about the characteristics and condition of the roof are at the top of the list when evaluating a residential policy.

In particular, roof age as a standard input to evaluate policies has been tremendously useful for insurers. Research shows that older roofs generally perform worse than new roofs and the data is a relatively easy input to collect from agents or applicants, or source from property record data.

But due to other factors, like weather conditions or maintenance—not every ten year old roof is the same. New inputs, like the true condition of the roof, improve risk selection and differentiation.

Cape Roof Condition Rating

Using computer vision and geospatial imagery, Cape Analytics developed Roof Condition Rating, a property attribute that assesses the condition of the exterior roof. Roof Condition Rating enables insurers to easily identify roofs that show signs of degradation, not captured by simply knowing the age of a roof.

Traditionally, assessing the exterior condition of the roof was only available by ordering individual property inspections. Now available instantly for homes across the U.S., carriers can easily integrate Roof Condition Rating as a standard input for risk management at the time of underwriting for every new policy application, or to evaluate their entire portfolio-in-force during renewals.

With a more granular view of their exposure, insurance carriers can:

- Optimize and reduce inspection spend

- Reduce reliance on agent and insured inputs

- More easily identify instances of fraud, where a roof was not replaced after a claim

- Assess the current condition of property prior to renewal

- Target the best risks at competitive prices; while avoiding potentially poor performing risks

For example, by understanding the roof condition at the time of quote, it reduces the need for an inspection and the likelihood that the premium will need to be adjusted after the policy is already bound, both streamlining operations and providing a better customer experience.

With the ability to understand the condition of any roof, insurers can now specifically select and prioritize the best risks, while avoiding risks that are more likely to result in a future claim.

Ultimately, insurers can reduce both operational expenses and losses, while growing premium—all without sacrificing underwriting quality.

Roof Age: a highly variable input

At the macro level, analysis using roof age exposure information and associated claims data have shown that older roofs generally perform worse than new roofs. Multiple studies have been conducted, such as this article from RMS which highlights that “homes with older roofs generally corresponded with more claims, and claims of greater severity.”

However, carrier roof age data is typically not accurate. This 2013 Claims Journal article written by BuildFax notes that “more than two-thirds of all homeowner-supplied roof ages (HOSRA) are underestimated by more than five years, and that more than twenty percent are underestimated by more than fifteen years.”

Roofs age and deteriorate at different rates based on their environmental conditions, such as sun exposure or temperature variations, or damaging events, like hail or wind storms. Several studies by the Institute for Business and Home Safety (IBHS) and others, note on a micro-scale how shingle roofs age over time, from granule loss to unsealing and blistering. Over extended periods these effects manifest as widespread defects, such as discoloration, exposed mats or underlayments, and missing shingles. Similar impacts are seen with tile or membrane roofs, in which peeling, missing tiles, or discoloration are obvious signs of roof degradation.

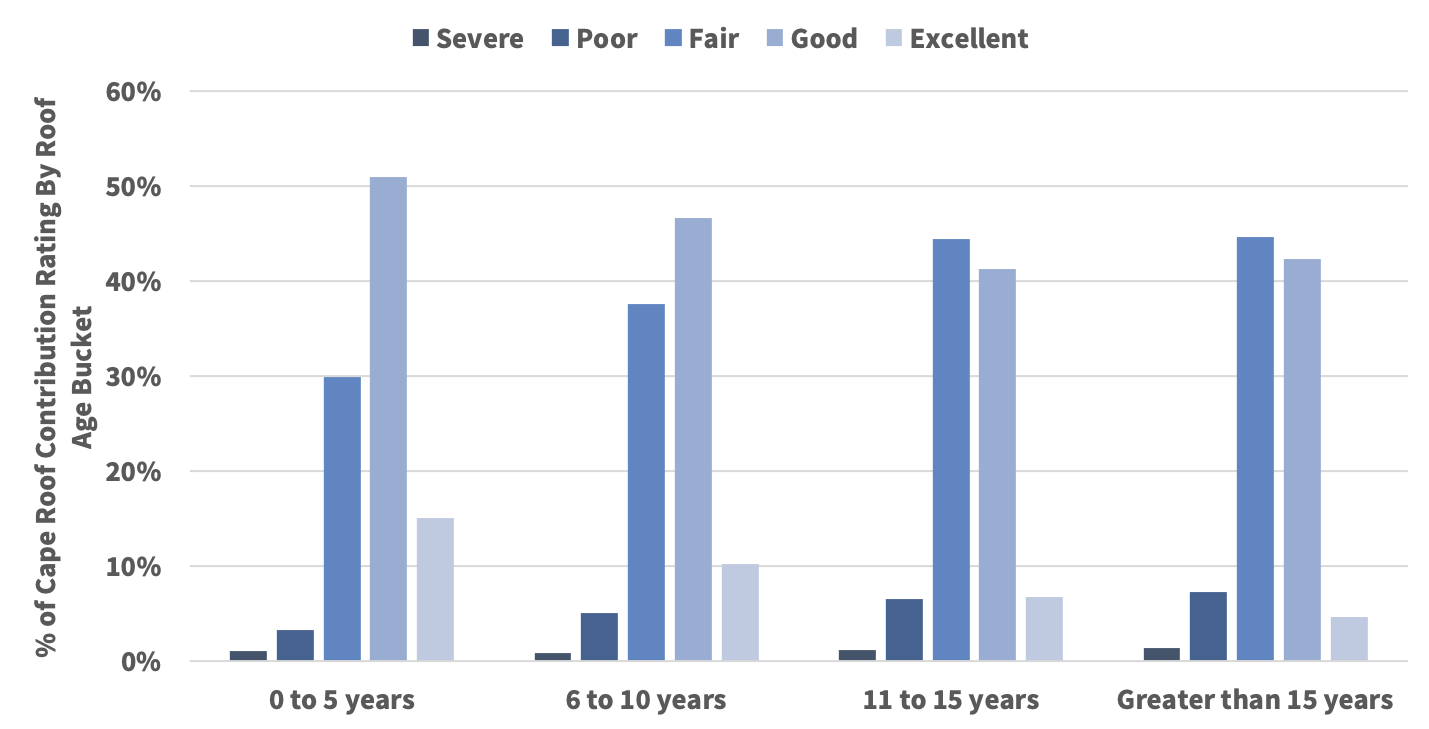

Roof Condition Rating supplements the highly variable roof age input by evaluating the actual performance of the roof. As evidenced in Figure 1, even newer roofs have the potential to be in bad condition, and a roof in great condition, but older than 15 years could be miscategorized.

Case Study: Predicting Loss with Roof Condition Rating

In a preliminary claims study conducted on a sampled portfolio distributed across the U.S., Cape Analytics worked to quantify the value of Roof Condition Rating in identifying roofs with increased potential for higher claims frequency and severity. The claims history was compared against the Roof Condition Rating as calculated based on imagery of the structure before the claim occurred.

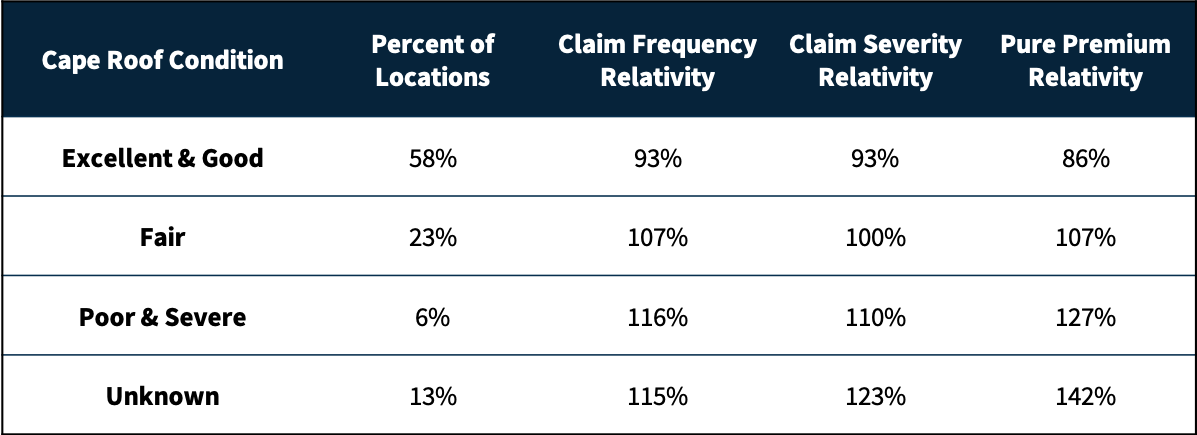

The claims history was broken down into the specific metric categories, which are Excellent, Good, Fair, Poor, and Severe. For sake of simplicity, Excellent and Good were grouped (E&G) and Poor and Severe were grouped (P&S) in the results. The results illustrated that P&S roofs had both an increased claim severity (10%) and frequency (16%), resulting in a pure premium 27% higher than average. Relative to E&G roofs, P&S roofs had a 19% higher claim severity and 25% higher claim frequency with a total pure premium difference of 48%. Interestingly, roofs with an Unknown Roof Condition Rating, typically due to obscured roofs from overhanging trees, also performed worse than the portfolio average, with an increased claim frequency of 15% and increased claim severity of 23%.

When evaluating relative loss performance at the portfolio level, this analysis demonstrates that the P&S roofs underperformed the average roof by nearly 30%, highlighting the potential for Roof Condition Rating as a rating differentiator.

Illustrating an increased contribution to loss compared to premium, P&S roofs represented only 4% of earned premiums, but accounted for 11% of losses. This showcases a scenario in which identification of P&S roofs could have mitigated increased losses either through choosing not to insure the risk, or improved rating that would have increased the premium requirement for the exposure.

While more advanced metrics and increased sample sizes well over one million locations will be showcased in the near future using additional exposure and claims data, it’s clear that by utilizing Roof Condition Rating at the point of underwriting or during renewal, insurers get better insight into roof related risk.

Interested in evaluating the impact of Roof Condition Rating on your portfolio? Contact us here.

1Insurance Information Institute – www.iii.org/fact-statistic/facts-statistics-homeowners-and-renters-insurance

Aggregate Statistics Created Using Data Produced from Nearmap Imagery