How Insurers are Inheriting Living Area Data Errors and Miscalculating Replacement Cost

Obtaining accurate living area measurements is a crucial aspect of the property insurance industry. Insurance carriers use living area measurements to calculate the replacement cost of a property in the event of damage or loss and to suggest coverage levels to the insured. It is essential to verify that the living area measurement is accurate to avoid overestimating or underestimating the replacement cost. However, obtaining accurate living area measurements is plagued with issues and challenges — most of them occurring in ways that have been historically impossible to identify or verify.

Living Area Data Comes from Disparate Sources

One of the primary sources of living area data are public records. Public records are reported by over 3,000 counties in the United States. Each county has its own standard for reporting living area, which can range from a single number to a detailed breakout of sub-areas in the home. Moreover, how below-grade and finished attic living spaces are handled varies, and the recency of information depends on the property’s built, remodel, and sale dates.

Public records, though useful, have a tremendous amount of nuance and inconsistencies that are challenging to grapple with. These inconsistencies make their way into all existing sources of property information.

Living area data may also be gleaned from agent portals, raters, or even directly from the homeowner. Property information is often entered into carrier portals and comparative raters by an agent seeking the best coverage at the best price. However, agents often lack firsthand knowledge of the living area, have limited ability to validate consumer inputs, and are under pressure to get an attractive price to keep the customer within their agency. Importantly, even homeowners may not have detailed figures for living area, and would not be well-versed in how finished sub-areas are broken down, as may be required by replacement cost tools.

Living Area is Inconsistently Defined

Still, there is a more foundational issue at hand: the very definition of living area.

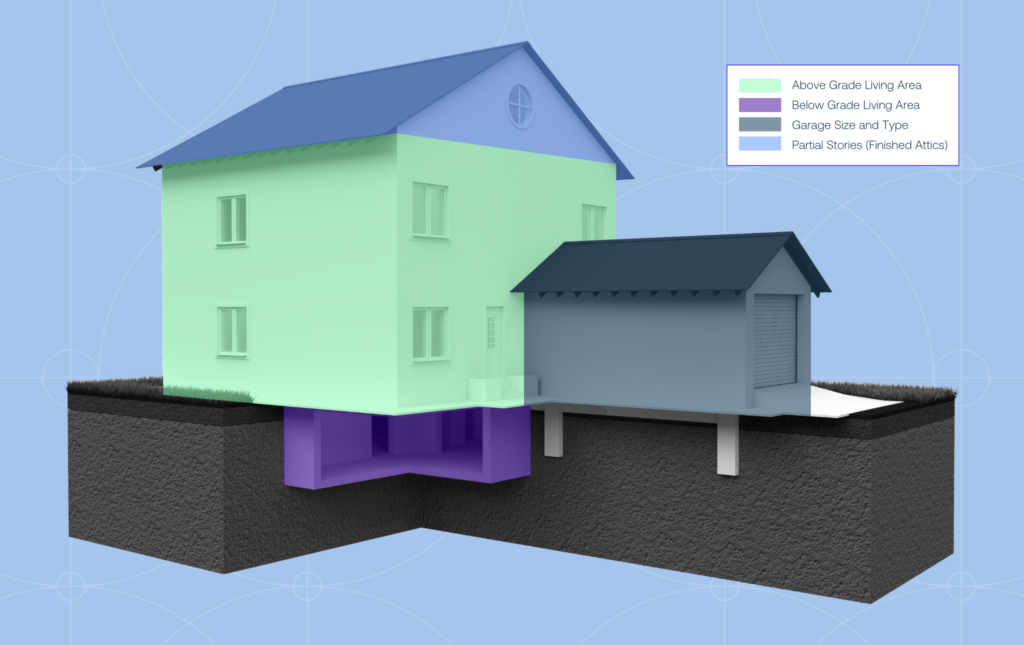

There are several ways to define and therefore calculate living area. Living area can be calculated by considering only above-grade or including below-grade construction. It can be relegated to ‘heated’ areas, or it can include unfinished areas, stairs, and landings. Living areas are labeled “base,” “sub,” and “total,” among other potential sub-groupings, which can make it challenging to obtain a measurement that aligns with a carrier’s definition and needs.

Pre-populated solutions also vary in fields collected and how they are used. Carriers often use commercial replacement cost estimation solutions that gather public record data. These solutions differ in what fields they collect and what fields they use. With the other challenges listed above, the potential for using the wrong information becomes clear.

One definition includes both finished above and below-grade areas, another excludes below-grade, and some even consider certain garage types and sizes as part of their measurement. Therefore, it is essential to ensure that any data solution used is accurate, consistent with the carrier’s definition of living area, and provides the necessary fields required to obtain accurate living area measurements.

The Impact of Inaccurate Living Area Measurements

These intricacies and issues add up: In a national study of hundreds of thousands of policies, CAPE has found that over 5% of policies in a typical carrier’s book have errors in living area exceeding 30%, with a large majority being underestimations. With the average square footage of a single-family home clocking in at 2,273 square feet and the average annual premium running $1,428 (or $.63 of premium per square foot), an error of 30% means carriers may be undercollecting over $400 in annual premium, on average, while also severely underestimating the true replacement cost for those structures. In cases where the living area is severely overestimated, carriers are uncompetitive in price and face the risk of churn by existing customers.

Obtaining accurate living area measurements is essential in the property insurance industry. However, between different nomenclatures, different measurement methods, and different needs, getting an accurate living area estimate is not easy. The challenges broadly fall into three categories: variations in reporting, variations in the calculation, and variations in usage. These variations introduce errors into every solution serving the market today and are meaningfully impacting carriers’ businesses.

CAPE’s Primary Property Elements, a set of foundational property data points including living area, aim to solve these challenges. These AI-powered data points are the first to leverage machine learning, geospatial imagery, and other novel data sources to fuse, interrogate, and analyze property records in order to identify outlier data points and deliver high-accuracy insights into living area and 25+ additional foundational attributes.

Reach out to our team for an evaluation of your book of business and to see how many of your policies have significant living area outliers, or learn more about Primary Property Elements here.

Aggregate Statistics Created Using Data Produced from Nearmap Imagery and Other Data Sources