Commercial Property Intelligence

Automate what can be automated, efficiently underwrite everything else

Efficiently access deeper COPE information to support small commercial, habitational, and mid-market commercial underwriting.

Commercial property underwriting workflows vary with the size of each property.

Workflows can be completely automated for small commercial, human-controlled for habitational property, and a mix for mid-market. CAPE® provides the best COPE data in the appropriate workflow as quickly and easily as possible.

As underwriting workflows become more automated, the API provides risk signals while the application supports the human review of exceptions and more complex property types.

Benefits

Gain visibility into loss-predictive property characteristics to make better underwriting decisions and match rate to risk

API access to property insights for completely automated quote and bind workflows.

Workflows to handle exceptions and complex risks quickly and accurately

Assess property characteristics and risk factors with CAPE’s commercial solution:

-

“Compared to the alternatives that we’ve looked at, the information from CAPE is more accurate. We can rely on that information and feel comfortable about the risks that are coming in, or the risks that are passing through.”

A Deeper Look at CAPE Commercial Property Intelligence

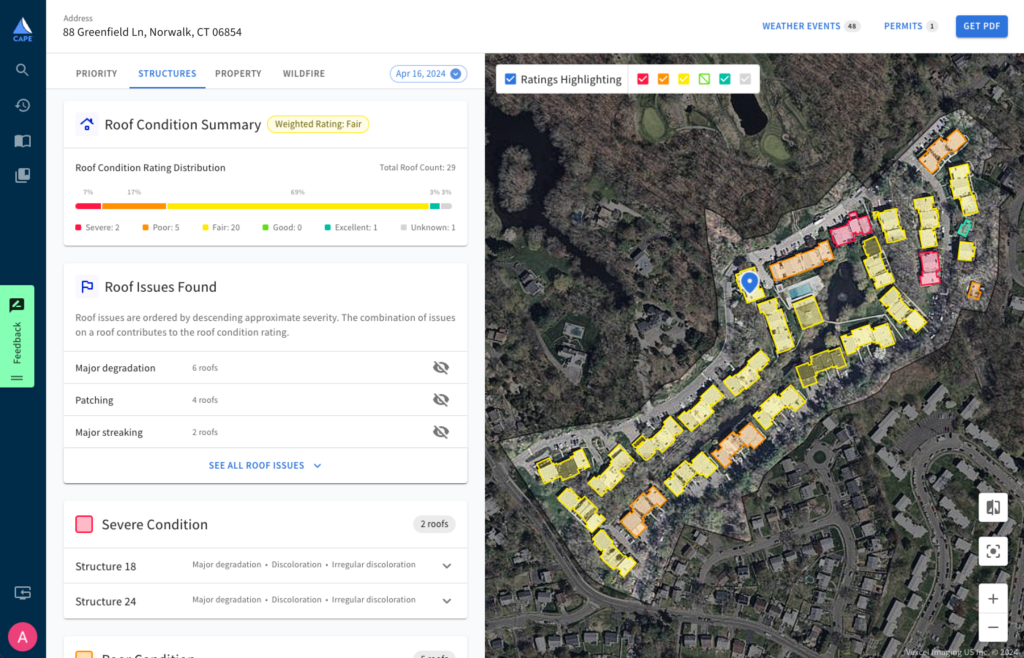

The CAPE commercial solution includes a growing set of property attributes, anchored by the gold-standard Roof Condition Rating, that support rating and underwriting. Property data can be accessed via API, Batch, or using the web application to fit into the appropriate workflow.

Understand the condition of a commercial property with roof condition and lot debris

Parcel-level intelligence includes the number of structures and parcel size

Gain insights into paved area deterioration and illumination

Instant access to hazard information and property-level vulnerability to risks like wildfire

Roof Condition Rating for Commercial Lines

Built specifically for commercial properties, CAPE’s commercial lines RCR provides a score on a 5-point scale that indicates the overall condition of complex small, mid-market, and habitational roofs.

Accompanying reason codes give additional insight into each rating, providing improved explainability.

CAPE clients have reduced the number of inspections while improving the quality of their book of business

CAPE clients have minimized downstream underwriting expense and unexpected loss by catching ineligible business at the time of submission

CAPE clients have streamlined underwriting efficiency, reducing time spent on an application by up to 80%

Video: CAPE for Small Commercial Insurance

Read The Latest CAPE Commercial Insights