Commercial Roof Risk Assessments: What Property Insurers Need to Know

For commercial lines property insurers, roof-related risk stands as a crucial determinant of insurability. Understanding the often-overlooked expanse above that corporate campus, retail mall, bustling warehouse, or habitational complex is business-critical due to the significant impact roof damage can have on insurance claims and carriers’ bottom line. While data on roof risk for residential properties has emerged in recent years, data for commercial roof risk has become just as important. Despite outperforming personal lines with a combined ratio of 97.7 in 2023, the rising frequency and severity of extreme weather events mean commercial roof risk assessment has never been more important—if you know what to look for.

Five Key Takeaways

- Today, roof-related claims cost commercial property insurers as much as $60 billion annually, representing as much as one-third of all losses

- Physical inspections of commercial roofs can be logistically challenging and prohibitively expensive—especially when evaluating a large number of properties across an insurer’s portfolio.

- Many carriers have turned to roof age as a data point for reserving physical inspections for higher-risk properties, but on its own, this data can’t offer a comprehensive understanding of the roof’s current state.

- Advances in aerial imagery, machine learning, and other forms of AI provide a faster, more accurate approach to determining both the age and condition of a commercial roof.

- The key is to strictly limit sourcing to providers offering models tuned specifically to commercial rooftops and associated losses—something only certain providers can deliver.

The Importance of Understanding Commercial Roof Risk

Understanding the condition and potential risks associated with the roof is central to accurately assessing the insurability of a commercial property and determining appropriate coverage levels and premiums. Today, the financial toll of roof-related claims ranges between $30 and $60 billion—a sizable chunk of overall commercial property losses of nearly $200 billion annually.

It’s easy to see why. Commercial roofs tend to encompass a larger proportion of the building envelope relative to single-family homes. They also face growing exposure to extreme weather events. According to Marsh McClennan’s 2024 Commercial Property Insurance Trends report, the prevalence of hailstorms in the Great Plains, the impact of hurricanes in the Southeast, and wildfires on the West Coast, amplified by climate change, represent a growing threat. What’s worse, the report adds, is that inadequate modeling capabilities for these risks are leaving insurers vulnerable.

The costs are up fast. In 2015 for instance, wind and hail-related damage accounted for 15% of all commercial claims. But reports of storms spawning hailstones of one inch or larger grew 28% just between 2021 and 2023, according to the National Oceanic and Atmospheric Administration’s Storm Prediction Center. One insurer reported more than $6 billion in payouts from hail-related damages last year—more than the previous two years combined. And as Forbes points out, inflation has sent the cost to repair roof damage from hail soaring. Put together, these figures underscore the necessity for insurers to assess roof risks to accurately evaluate the potential financial impact across their portfolios.

Assessing Condition: Boots-on-the-Roof and Beyond

Traditionally, insurers have relied heavily on sending inspectors to physically assess commercial roofs, which can be resource-intensive and logistically challenging endeavors. In many cases, inspectors or risk engineers can’t even fully inspect a roof directly due to access issues, business constraints, liability risks, and other factors. The cost of sending qualified inspectors to various commercial properties across different locations can quickly accumulate—especially when carriers are evaluating a large number of properties within their portfolios.

Not only does this put a strain on resources, but it can put insurers at a competitive disadvantage by impeding their ability to provide prompt coverage decisions or issue policies—potentially affecting customer satisfaction and operational efficiency. As a result, many carriers have turned to roof age as a data point for helping direct inspectors to higher-risk models. The age of a commercial roof provides insurers with a quick and reliable indicator for potential vulnerabilities, expected lifespan, and likelihood of incurring damage. And it makes sense. Older roofs generally perform worse than newer ones. In fact, CAPE offers an imagery-based roof age product trusted by top-20 insurers.

Yet valuable as it is, roof age data alone doesn’t provide a comprehensive understanding of the roof’s current state as maintenance practices, environmental factors, and other variables can greatly influence condition and durability. For example, commercial roofs are more likely to be repaired rather than fully replaced. But agent-submitted information may erroneously indicate a complete re-roof, resetting the roof age inaccurately—resulting in incomplete risk assessments. The good news: There’s a better way.

Roof Positive: Aerial Imagery & AI Insights at Scale

Today, advances in aerial imagery and machine learning offer a preferable and more accurate approach to directly determining both the age of the roof and its condition. This approach enables carriers to conduct detailed assessments of commercial roofs without the need for onsite physical inspections. For underwriters, key advantages of this approach include the ability to:

- Capture a comprehensive and up-to-date view of the roof

- Identify any recent damage, ongoing deterioration, or potential risks not reflected in roof age alone

- Achieve speed and scale while removing human subjectivity and variances

Machine learning algorithms applied to aerial imagery make this all possible by extracting valuable information regarding the roof’s condition—including the presence of material degradation, tarps, missing material, pooling water, and more. These machine learning algorithms are trained on vast aerial imagery datasets and corresponding ground truth information, including historical claims data, to recognize patterns and features indicative of roof condition. This enables them to accurately classify and evaluate roofs’ susceptibility to damage.

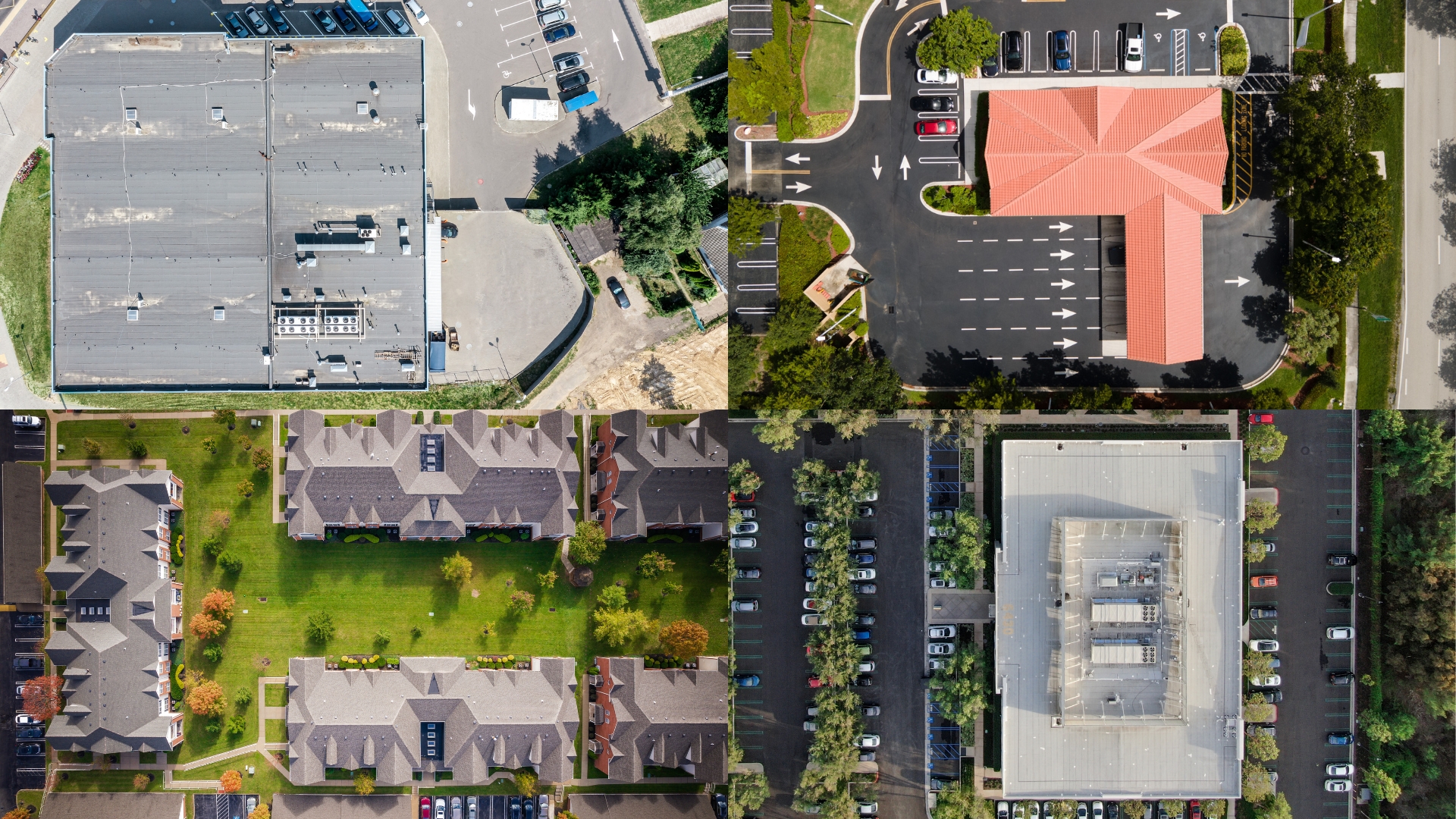

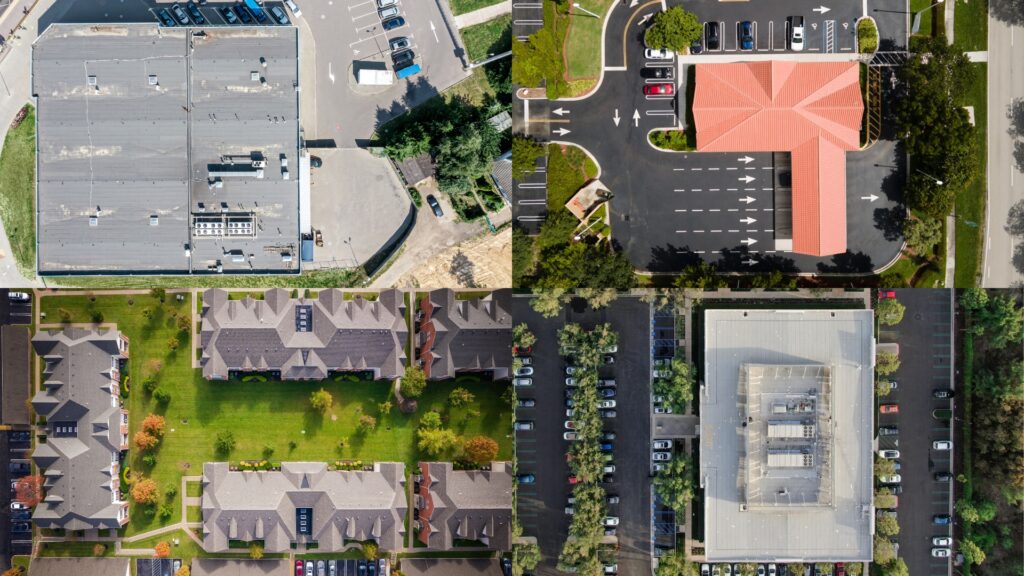

Using aerial imagery and machine learning also allows carriers to quickly evaluate commercial properties across their portfolios and maintain an up-to-date database of risk exposure—a capability that will be increasingly critical in a hardening and challenging reinsurance market. However, CAPE realized that a model trained on residential roofs would not provide the accuracy needed to assess complex commercial roofs.

CAPE Redefines the Game, Again

In 2017, CAPE introduced the first AI and aerial imagery-powered roof assessment product, Roof Condition Rating (RCR). CAPE’s RCR is now used by over 70 insurance carriers across the US for underwriting, pricing, and loss control.

Due to the intricacies and peculiarities of commercial roofs not often present in residential roofs, CAPE launched a version of RCR that’s purpose-built for the commercial market. By developing the first and only commercial property-specific model in the market, we were able to address significant differences inherent in commercial roofs, which include:

- Larger than single-family homes

- Use different covering materials

- Have flat membrane roofs that often have ponding or discoloration but remain entirely functional

- Experience claims that differ greatly from those in the residential market

CAPE’s solution offers the most nuanced and predictive model focused on commercial rooftops and associated losses. The AI underpinnings of our latest version of this solution include greater transparency with the addition of different Reason Codes, or details on specific roof issues surfaced by the model. This enables underwriters to clearly communicate decisions to brokers or agents based on objective data derived from aerial imagery—removing ambiguity from the conversation.

“Across the US, 20% of commercial roofs are in poor or severe condition.”

CAPE RCR for Commercial Properties consists of six labels: Severe, Poor, Fair, Good, Excellent, and Unknown—indicating the presence (or lack thereof) and severity of visible roof defects. Across the US, 20% of commercial roofs are in poor or severe condition, while 45% are in good or excellent condition. We compare RCR against an exposure and loss database provided by insurance carrier partners consisting of millions of exposure records and hundreds of thousands of location-level claims to ensure an unprecedented level of accuracy and predictiveness.

Prediction: Better Results

According to McKinsey, insurers employing advanced data analytics technologies can see loss ratios improve up to 5%, premiums rise as much as 15%, and retention of their most lucrative segments climb as much as 10% compared to less data-savvy rivals. Roof condition is the cornerstone of property insurance—making access to roof condition data paramount to achieving these kinds of results.

CAPE Roof Condition Rating for Commercial Properties provides the scale and accuracy needed—and is the only solution backed by a commercial property-specific model. By leveraging AI and high-resolution aerial imagery, commercial lines carriers can confidently assess and manage risk, streamline underwriting, reduce application times by up to 80%, and navigate the changing commercial property market as never before possible.

Interested in learning more about CAPE’s commercial property-specific roof risk solution? Request access to our latest white paper below.

CAPE White Paper:

The Importance of Assessing Roof Risk for Commercial Properties

Aggregate Statistics Created Using Data Produced from Nearmap Imagery