CAPE Data Finds Pandemic-Driven, 533% Surge in New Backyard Swimming Pools

If the local news reports are any indication, the coronavirus pandemic has had an unexpected side effect: an enormous spike in demand for backyard swimming pools. Now, CAPE Analytics has the geospatial property data to prove the size of that spike.

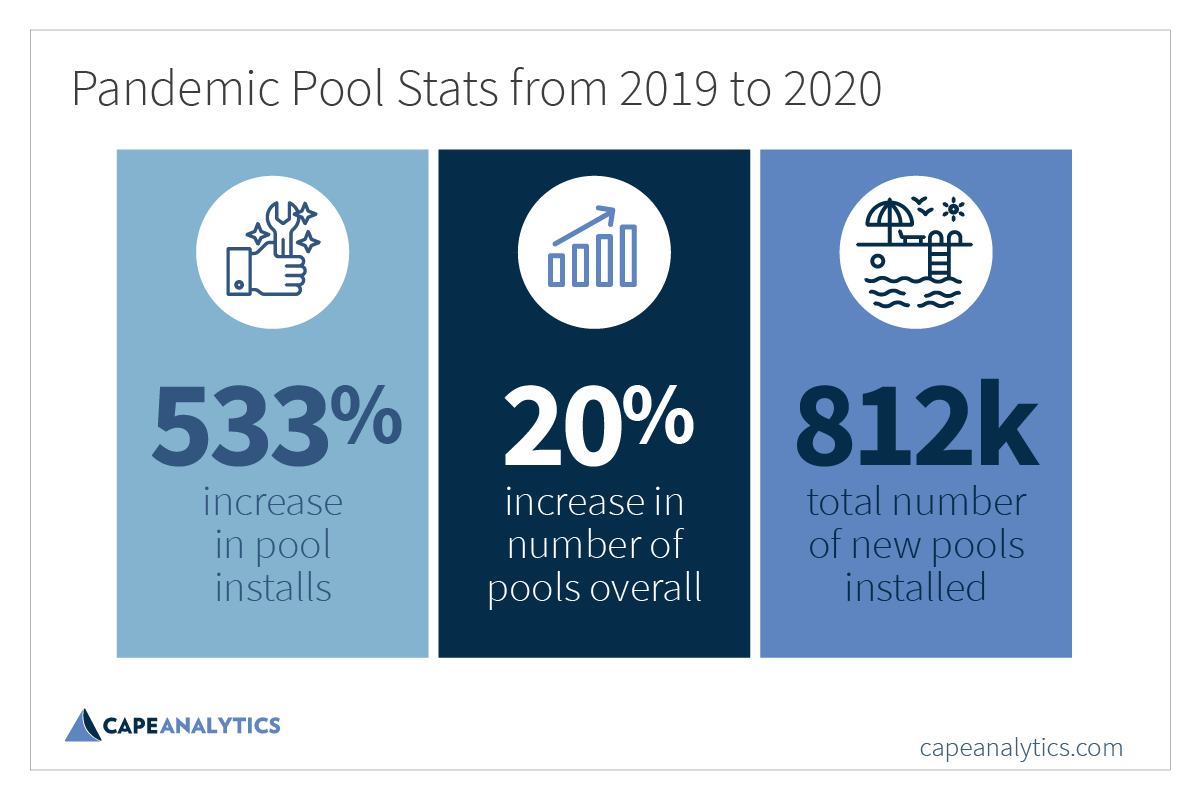

Among the key findings: A 20% increase in backyard swimming pools in just 12 months, representing a rise of as much as 533% over recent years. We’re talking in-ground, above-ground, inflatables, hot tubs—whatever floats your boat. But let’s back up a bit to get the full picture.

As last spring’s COVID-related lockdowns gave way to a summer stuck at home with virtually nowhere else to go, the buzz was unambiguous. Backyard pools became the new beach vacation.

“The phone started ringing once COVID hit,” one above-ground installer told the Tampa Bay Times last August. “They’ll say, ‘We’re home, my kids are going crazy, I need something for them to do. They can’t go to the park, they can’t play with their friends. They’re going crazy,’” he said.

Chris Durbin, owner of Buckeye Pools in Centerville, Ohio told the Dayton Daily News that his company saw a 300% increase in inquiries last summer. “When the shutdown was announced, I thought things would come to a screeching halt,” he said. “I don’t know if I’ve ever been so wrong about anything in my life.”

But while anecdotes like this abound, getting reliable, aggregated data about COVID-era pool installations on the state and national level has been hard, if not impossible to come by—until now.

Geospatial Property Data Shows Nearly 20% Increase in Total Pools

According to CAPE Analytics’ data, there was a 20% increase in the number of in- or above-ground backyard pools among the single-family homes CAPE analyzed between October 2019 and October 2020.

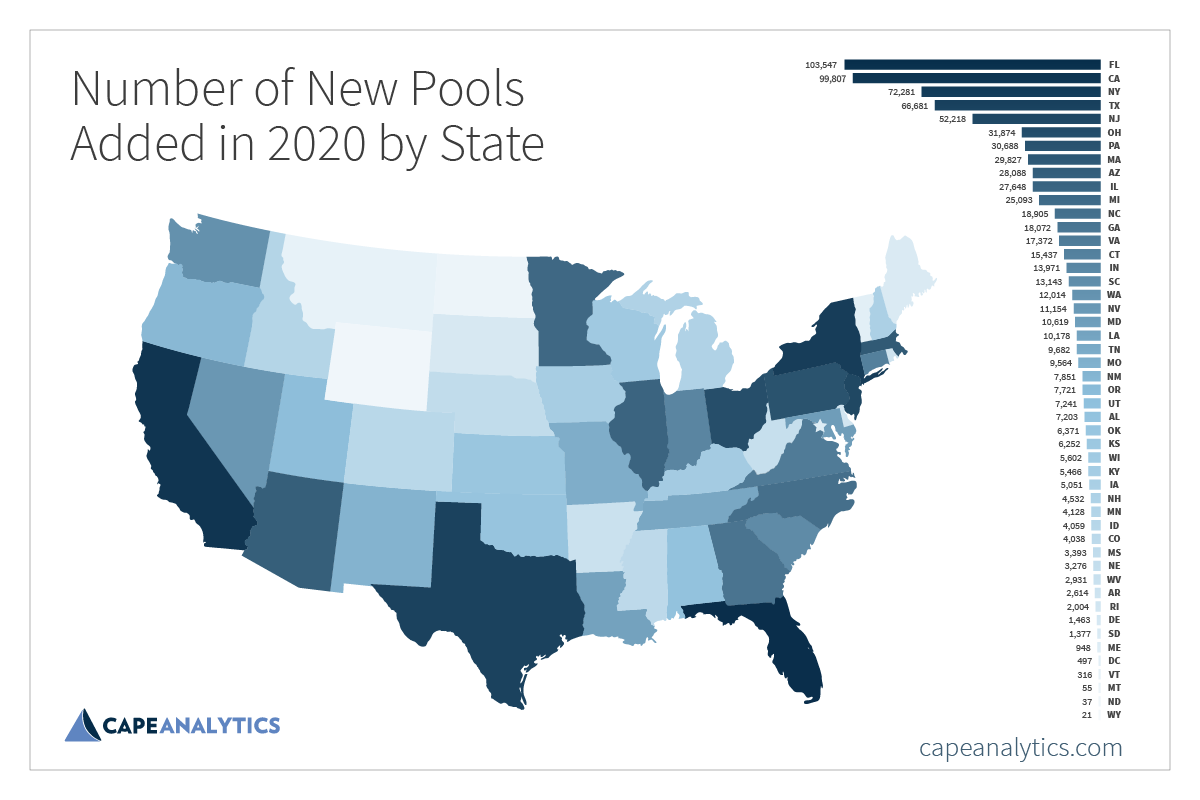

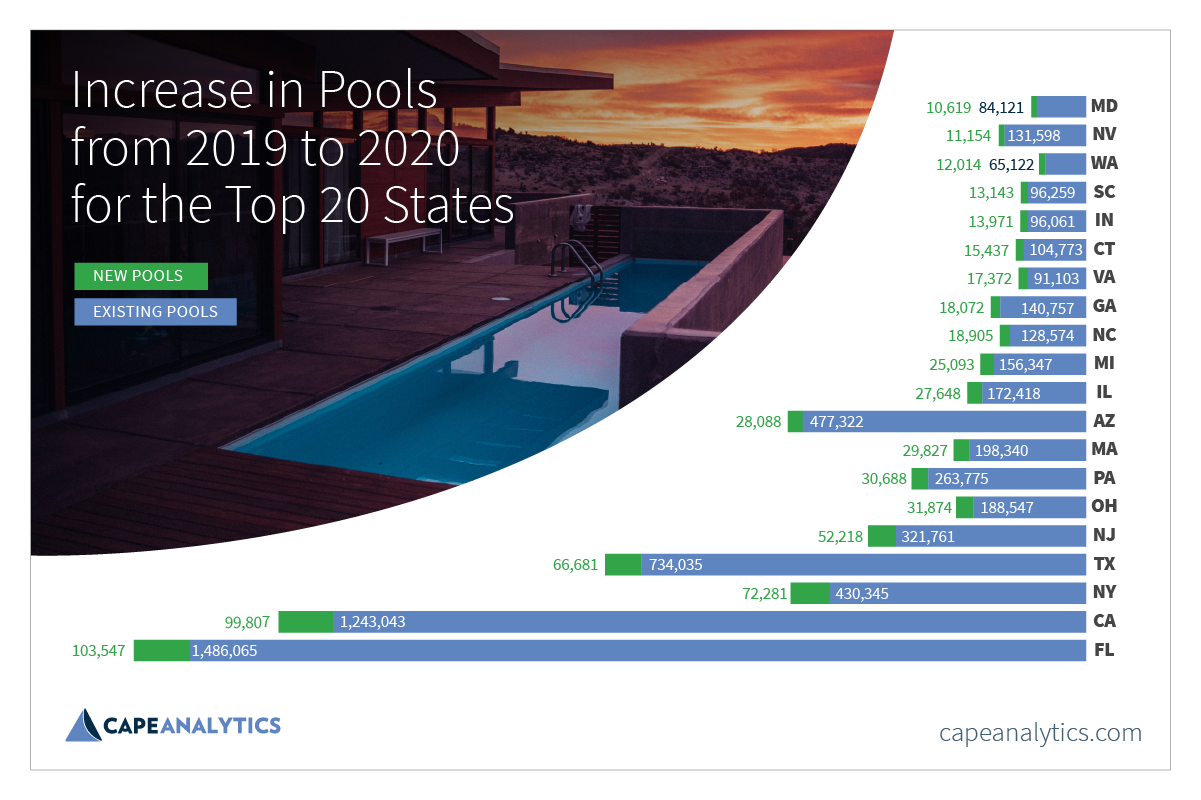

In absolute terms, Florida and California, which have always been home to the highest number of swimming pools, saw the largest gross number increases (see accompanying chart for more).

In October 2020, there were 1.4 million backyard swimming pools in the state of Florida—an increase of 103,547 (or 7.5%) year-over-year. In California, October’s total of 1.2 million backyard pools reflected an increase of 8.7% during the same period. As one might expect, states with much lower baselines saw far higher increases on a percentage basis.

The data is drawn from CAPE’s AI-powered solution, which uses high-resolution geospatial imagery, captured by Nearmap and other providers, to analyze housing characteristics and trends across the United States. As such, the data reflects a comparison of actual pool installations year over year, versus other measures, like inquiries, sales, or building permits.

The numbers might have gone even higher in 2020, had it not been for a shortage of available workers, materials, and chemicals.

“The problem is, we can’t get any more inventory from the manufacturer,” Jim Carr, owner of in- and above-ground pool business Mr. Pools Inc., told the Tampa Bay Times. “The manufacturer can’t get more because of the coronavirus.”

533 Days of Summer: Long-Term Wave–or Short-Term Splash?

Whether growth in backyard pools continues into 2021 and beyond remains to be seen—though early signs and pool chemical shortages suggest that is the case. But as the world reopens, beaches, water parks, and other destinations beckon, which could put a crimp on pool sales. Then again, they’d have to drop a long way to return to historic norms.

As recently as July 2019, Bloomberg reported a 4.6% drop in pool repair and construction activity, and that nationally, new construction of in-ground pools had been averaging roughly 75,000 for years. Given that there’s an estimated 47% to 50% split between above- and in-ground pools, these assumptions puts the total number of new pools at roughly 150,000 in a typical year.

By comparison, the sampling of homes captured in our snapshot shows an increase of more than 800,000 net-new pools, above- or in-ground, nationwide between October 2019 and October 2020.

This represents a 533% increase from the norm for net-new pools in a given year. And that’s with the aforementioned supply chain shortages.

Then again, if the past year has taught us anything, it’s that anything is possible. And since CAPE’s data collection regimen is designed to capture aggregate changes over time, you can be sure that we’ll be pulling the data this fall to see if 2020’s boom in backyard swimming pools continues to surge in 2021—or takes a dive off the deep end.

To learn more about geospatial property data and automated pool detection, click here.

Aggregate Statistics Created Using Data Produced from Nearmap Imagery