CAPE Property Mapper: Unlock Commercial Workflow Automation by Matching Policy Submissions to Exact Structures

Commercial property underwriting has long had two large obstacles standing in the way of full digitization and automation: inconsistent policy submissions and the complexity of the submitted properties.

In an attempt to combat inconsistent submissions, many carriers have resorted to implementing a “human-in-the-loop” workflow to translate and normalize the wide range of formats and data received from agents and brokers. This additional step is not only time-consuming and costly, but it inserts another layer of subjectivity into an already complex process.

Today, about half of incoming submissions suffer from different kinds of variability and inaccuracy including irregular data with unstandardized or incomplete addresses and bad geocoding, and difficult document types like emailed spreadsheets, forms, PDFs, or even pictures of a pieces of paper.

There is also the fact that commercial properties can often be difficult to understand, as with habitational and multi-structure properties where it is challenging to match the correct buildings to policies. As a consequence, underwriters can get tied up for hours with manual tasks like looking up imagery from Google Maps, manually geocoding building schedules, or hunting through county tax assessor websites for parcel sketches.

In the end, many commercial carriers are left to rely on overly complicated, time-consuming, and costly patchwork workflows that are a far cry from the efficient and streamlined underwriting processes required by the industry.

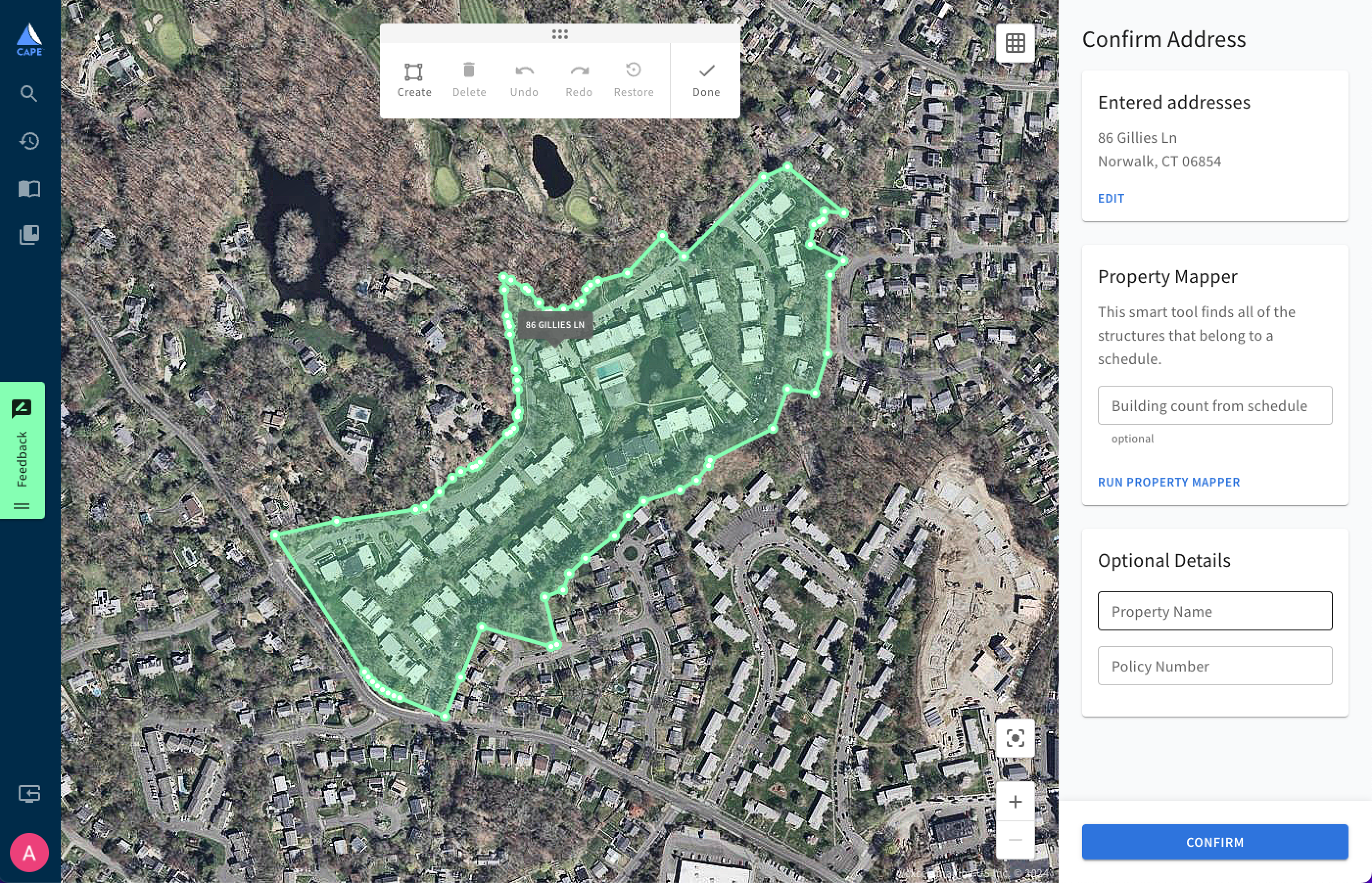

CAPE Property Mapper enables an automated approach to commercial underwriting, unblocking previously-obstructed downstream digitization and workflow automation. Powered by a sophisticated machine learning algorithm, Property Mapper connects both structured and unstructured information to instantly provide underwriters with clarity on the exact structures that should be evaluated in a commercial policy.

Available within our existing Commercial Property Intelligence, Property Mapper correctly and instantly maps information from a submission to a property by looking at the shapes of communities, similarities in structures, and the number of expected buildings to emulate the actions that an underwriter would take.

From one address or a schedule, Property Mapper identifies an area of interest on a map containing everything covered under the policy. This allows underwriters to gather property risk intelligence at the level of a policy rather than individual structure—reducing the time and effort it takes for commercial underwriters to understand which structures belong to a property.

Property Mapper is foundational for the industry to be able to leverage geospatial property insights at scale. Overcoming this beginning-of-workflow barrier allows carriers to be able to introduce more automation into the underwriting of complex commercial properties. By eliminating some or all of inefficient manual workflows, expense ratios are kept low and carriers are able to deliver a better customer experience.

Property Mapper enables underwriting automation driven by business rules. Using CAPE’s risk-predictive Roof Condition Rating, even complex submissions can be segmented so that properties with good roof conditions can be quoted immediately and those with poor roofs can receive underwriter review. This can lead to an improved customer experience due to faster turnaround times.

Ready to unlock the efficiency and cost savings of commercial workflow automation? Reach out to the CAPE Analytics team to learn more.