Commercial Property Reports Habitational, SMB, and Large Commercial

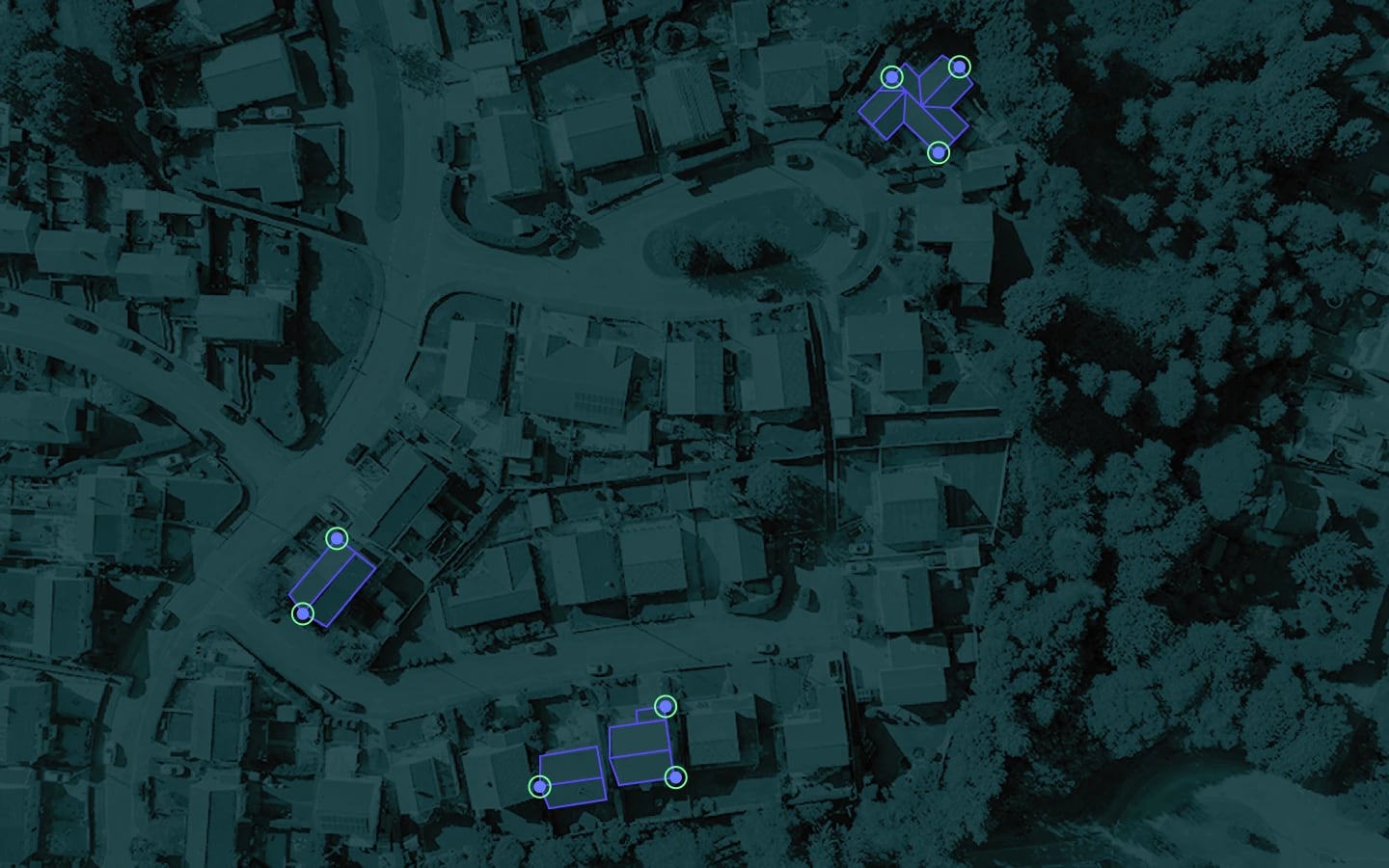

Commercial insurers require risk solutions built specifically for commercial properties. For the past five years, CAPE has made that investment.

These new reports reveal the immediate opportunity to automate portions of the underwriting process for commercial residential property risks, accelerate automation for small and midsize commercial property, and apply advanced property intelligence to underwriting some of the largest property risks.

Select the appropriate market segment below:

This report focuses on:

– The immediate opportunity to automate portions of the underwriting process for commercial residential property risks

– Carriers will discover how to earn short-term returns and long-term learning curve advantages in the race to automate commercial property underwriting