Insurance Case Study:

CSAA Insurance

Group

CSAA IG Improved Underwriting Quality and Efficiency by Utilizing CAPE Analytics’s AI-Based Property Intelligence

Home inspections are a significant underwriting expense for insurance companies in terms of the dollars, time and resources required. To help address this issue, CSAA Insurance Group, a AAA Insurer, partnered with CAPE Analytics to leverage its advanced AI technology to more quickly and inexpensively assess the condition of member homes.

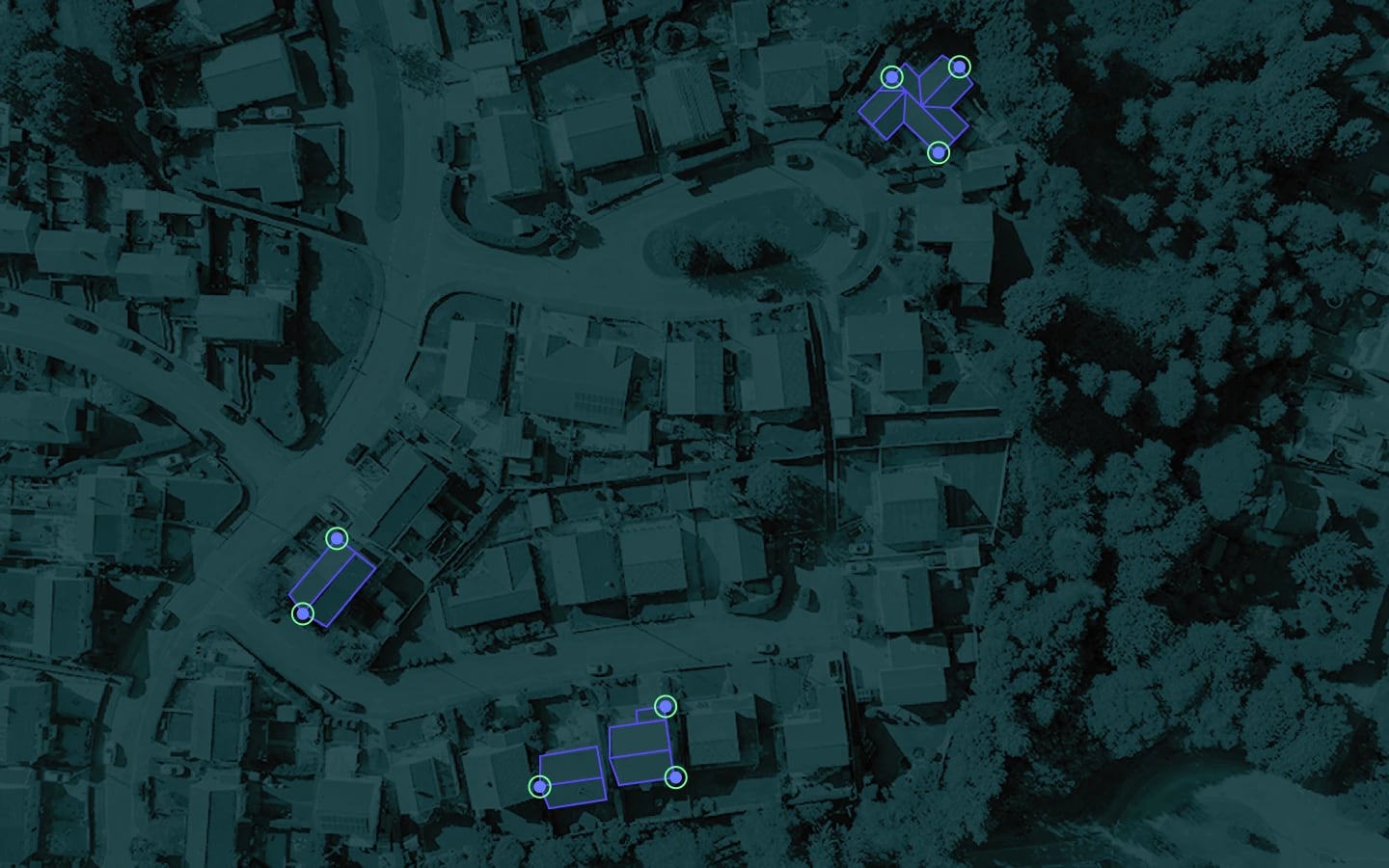

With a database of more than 70 million residential buildings in the U.S., CAPE Analytics provides timely and accurate property information by leveraging geospatial imagery, computer vision, and deep learning. CAPE Analytics’ algorithms can identify a range of impactful property attributes and loss-predictive signals. For example, Roof Condition Rating detects issues such as missing shingles, the use of tarps, or discoloration — all of which can be verified with targeted, in-person inspections, if need be.

The CAPE Solution

For existing business, insurers can utilize this technology to ensure accurate pricing at renewal, identify catastrophe exposures, and reduce their reliance on outdated sources of data. In quoting new business, insurers can improve the customer experience by providing a more objective underwriting decision because they can assess true roof condition in a timely manner.

The CSAA Impact

In the case of CSAA Insurance Group, CAPE Analytics’ technology has helped to more accurately quote home insurance policies, resulting in improved underwriting decisions, risk selection, and customer experience.

CSAA Insurance Group: Roof Condition Rating and property insights that impact the underwriting process

Insurance carriers have underwritten properties in similar ways, with similar results for a while. Legacy processes for underwriting property insurance typically include ordering an inspection at considerable time and expense, and often creating a negative experience for customers. More sophisticated techniques and data sources are emerging to help solve these problems. Most insurers use the age of a roof as a standard input. However, roof age does not provide an accurate measure of roof performance.

CAPE’s Roof Condition Rating allows CSAA Insurance Group to instantly assess the condition of a roof at the time of underwriting, rather than waiting for an individual property inspection. This roof scoring methodology is providing value to CSAA Insurance Group by revealing the true condition of a roof to more accurately evaluate risk, mitigate future losses, and detect potential fraud.

Being able to properly price and underwrite a home’s roof enables us to make consistent and objective underwriting decisions in our day-to-day business and help best insure and serve AAA members. We look forward to continuing our partnership with CAPE Analytics, and leveraging their technology to continually improve our business processes and member experience.

Brian Gaab

Managing principal of core innovation at CSAA Insurance Group

Results: Improved underwriting

quality and efficiency

By partnering with CAPE Analytics, CSAA Insurance Group was able to improve overall underwriting quality and efficiency, as well as customer experience. Specifically, CSAA used CAPE Analytics’ property intelligence to:

inspections of high-quality roofs.