Hail Losses: Nearly 80% of Insurance Professionals Highly Concerned, New CAPE Survey Finds

Recent data underscores a growing concern among property insurance professionals about hail losses in 2024, driven by severe convective storms causing unprecedented damage. There have been nearly 4,200 severe hail events to date in 2024, including a first-ever warning by the National Weather Service for DVD-sized, 5-inch hailstones in Texas this May. With first-quarter insured losses from severe convective storms alone reaching $11 billion, it is no surprise that the industry is increasingly focused on improving hail risk mitigation strategies.

CAPE recently conducted a robust survey of over 150 insurance professionals to better understand the industry’s current assessment of the growing frequency and severity of hail events produced by severe convective storms. The survey was conducted in June 2024 as part of CAPE’s webinar, “Time to Ex-Hail: How Imagery-Based Roof Age and Geospatial Analytics Can Reduce Hail Losses.”

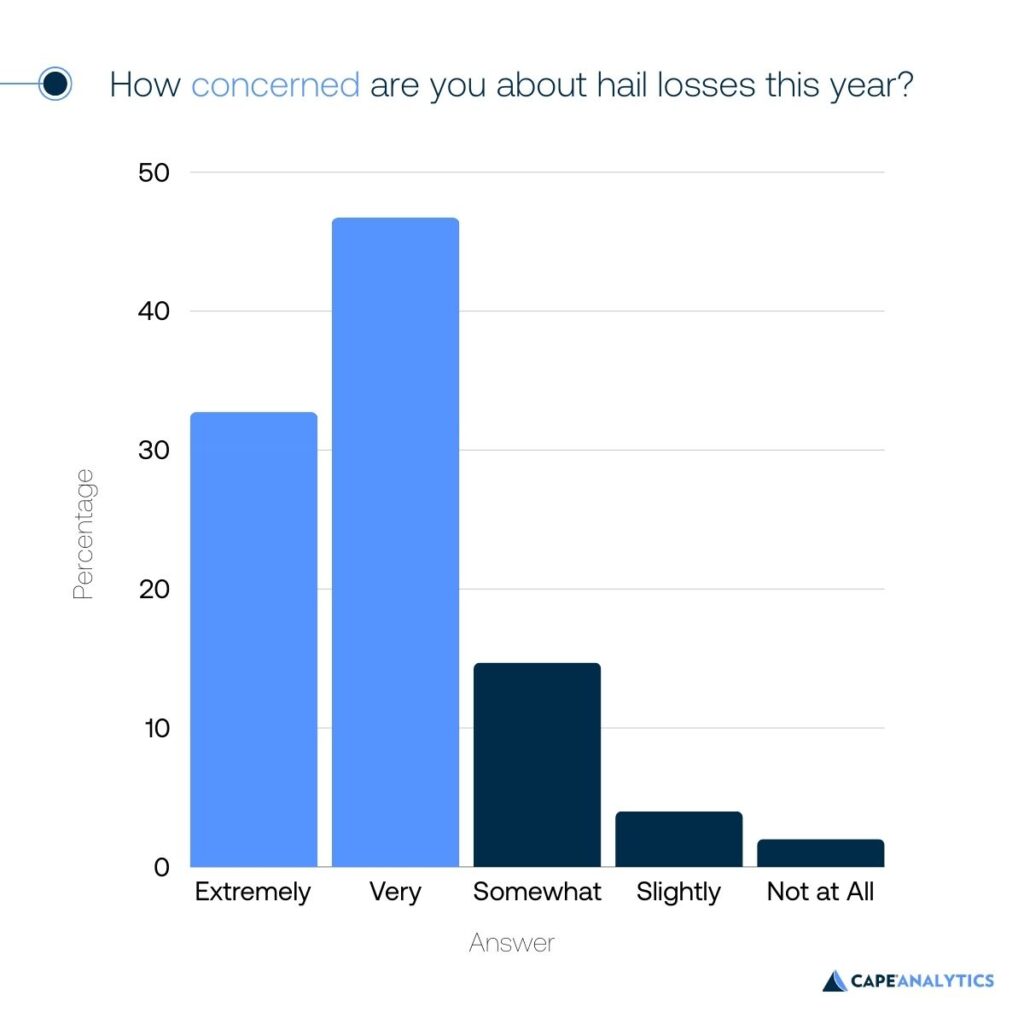

How concerned are you about hail losses this year?

Faced with this growing threat, it is no surprise that insurance professionals are highly concerned about hail losses this year. However, we can now quantify that concern: 32.7% are extremely concerned, 46.7% are very concerned, 14.7% are somewhat concerned, 4.0% are slightly concerned, and 2.0% are not at all concerned.

The bottom line: nearly 80% of those surveyed are either extremely or very concerned about hail losses. The 32-point drop off between “very” and “somewhat” is also particularly striking, representing a definitive divide between the majority and minority segments.

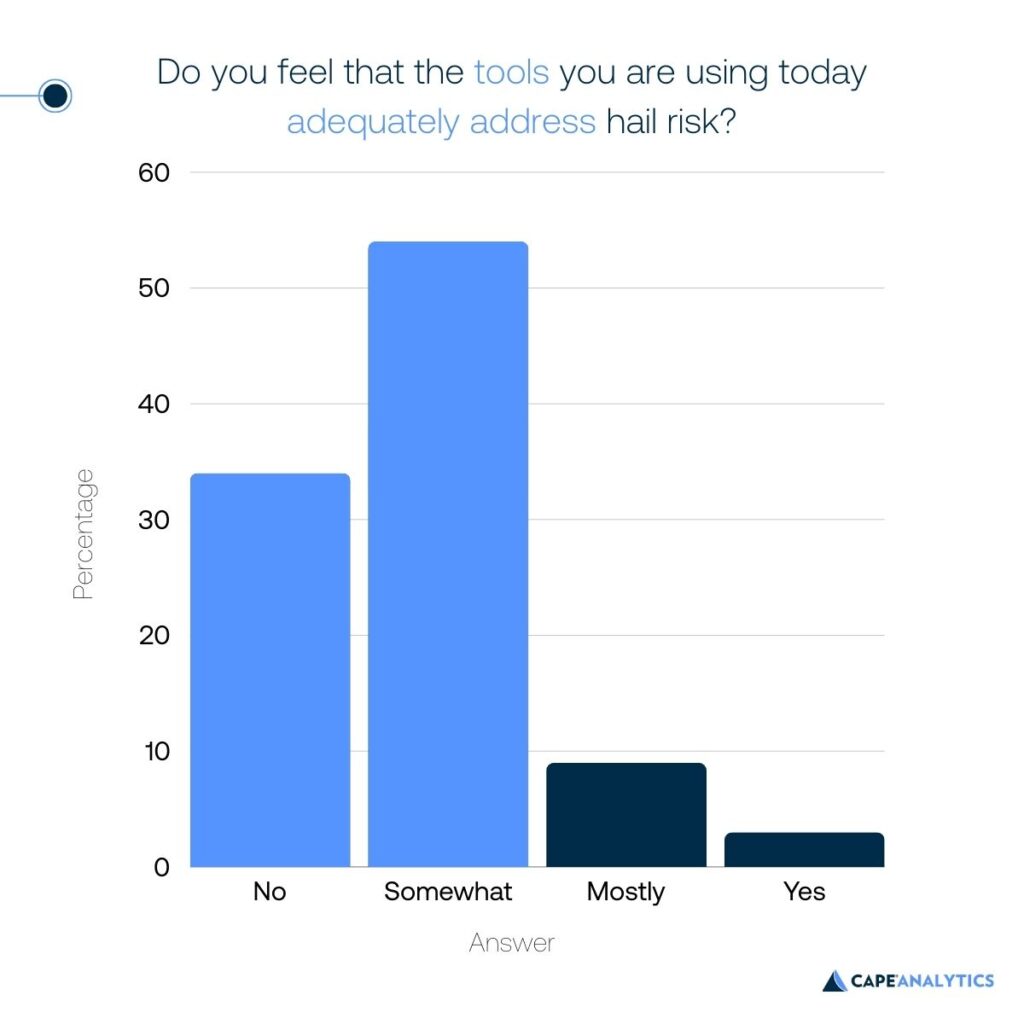

Do you feel that the tools you are using today adequately address hail risk?

Now that the degree of concern with hail losses is understood, how do these professionals feel about their organizations’ risk mitigation tools?

34.3% of those surveyed feel the tools they use do not adequately address hail risk, 54.3% somewhat, 8.6% mostly, and 2.9% yes. Again, the division is stark: 88.6% of insurance professionals feel that their current tools are inadequate.

Existing tools for assessing and mitigating hail risk are clearly falling short. However, the industry is beginning to turn to new technological innovations to better manage this rising peril.

Effective hail risk assessment

For insurance carriers and underwriters, using geospatial analytics with advanced, property-specific weather data results in a more reliable assessment of hail risk for individual properties.

CAPE’s hail solution provides a complete view of a given property’s hail risk, including recent hail experience, current structural vulnerability, and future potential loss severity. This enables carriers to make more informed policy pricing and risk management decisions, leading to more accurate underwriting, better customer segmentation, and an improved claims response following hail events.

Are you interested in CAPE’s approach to hail risk? Learn more about the CAPE Hail Intelligence Suite here.