Wildfire Risk Data Resolution: The Advantages of Property-Specific Information

By Kevin Van Leer, Client Solutions at Cape Analytics

Today, most carriers rely on a single-score method for making underwriting decisions in wildland-urban interface risk zones. Unfortunately, most in the industry have been badly served by relying on this approach, with many suffering tens of millions of dollars in accumulated losses from recent fires across the West, particularly in California.

The first consideration when comparing methods is to develop an understanding of the resolution of leading risk scoring tools available on the market today. Looking at both freely-available and high-end solutions, we find spatial resolution to vary between 30 and 270 meters. Although these scores may help carriers draw their coverage boundaries at the neighborhood level, they do not provide a granular, property-level understanding of risk. Due to this low resolution, score providers are forced to only look at environmental aspects, such as wind events, topography, climate, and general vegetation type. They cannot, on the other hand, look at factors at the property level that may affect risk exposure.

Let’s take a look at a particular residential neighborhood that sits at the wildland-urban interface:

Now let’s overlay a single-score map on top, to see what kind of results we generate:

Overall, this small neighborhood has single-score designations across the spectrum, from non-burnable to very high fire risk — often right next to each other. It’s easy to see how the scores can provide a sense of where carriers could draw coverage lines, but provide little opportunity for additional rate segmentation in border areas like this one.

What carriers need is additional signal around hazard and, in particular, vulnerability for individual homes. This can allow insurers to more confidently decide whether to adjust rate, non-renew, or even provide a discount due to extensive mitigation measures. To illustrate why this is important, let’s take a look at a few specific properties — each with identical fire risk, according to a widely-used single score method.

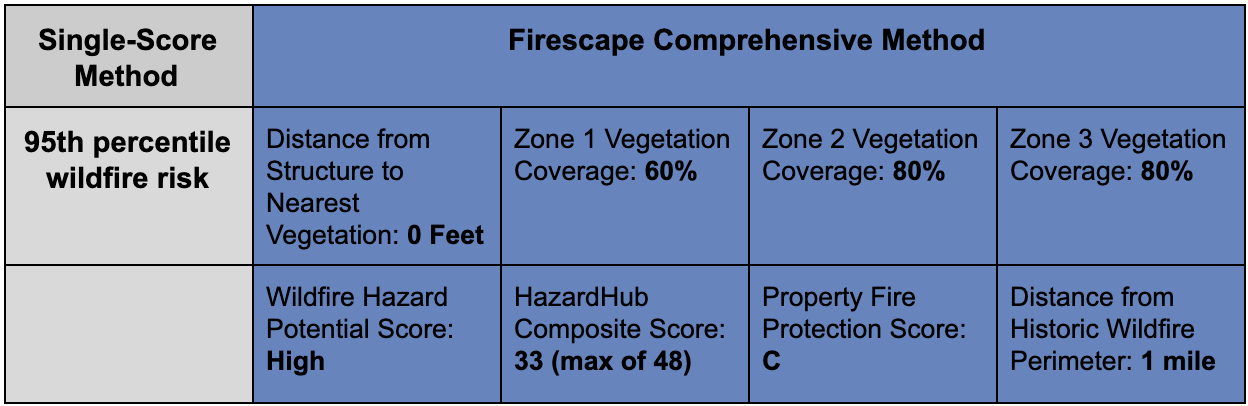

This property probably conjures up nightmares for some of our underwriting friends. It is in a high-risk potential area with dense vegetation at every zone of defensible space, with near-full vegetative coverage from the roofline to 100 ft away. It’s also just a mile from previous wildfires and has poor fire protection class (based on the property’s distance from a fire station, nearby fire hydrant, and other factors).

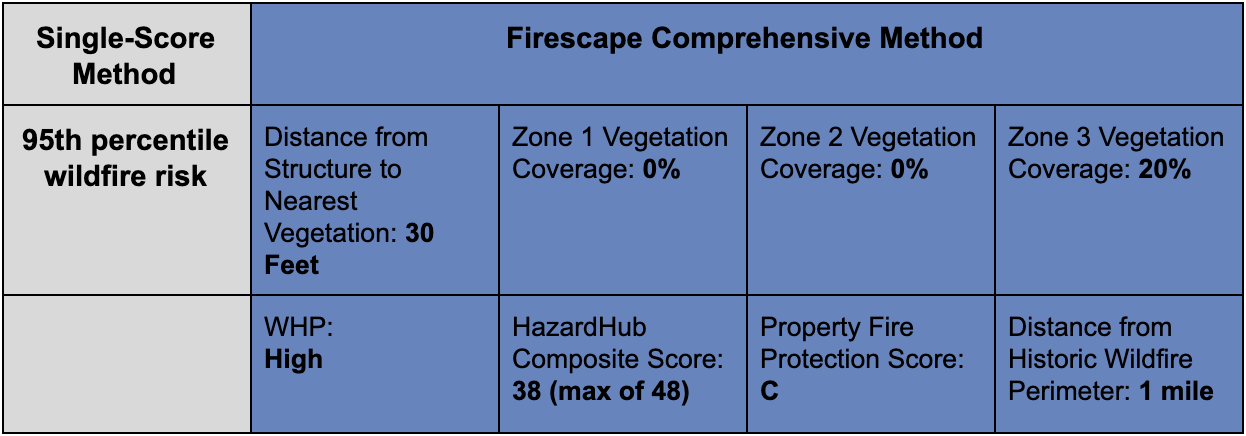

This property, on the other hand, has the exact same single-score risk in the 95th score percentile, with a similar Wildfire Hazard Potential and HazardHub Wildfire Risk score. However, in this case, the owner has clearly done some vegetation remediation, and the Cape Firescape model shows this clearly in its data output. As an underwriter, which property would you rather cover? The answer should be quite clear, and yet a single score method would miss the necessary information to make such a granular decision.

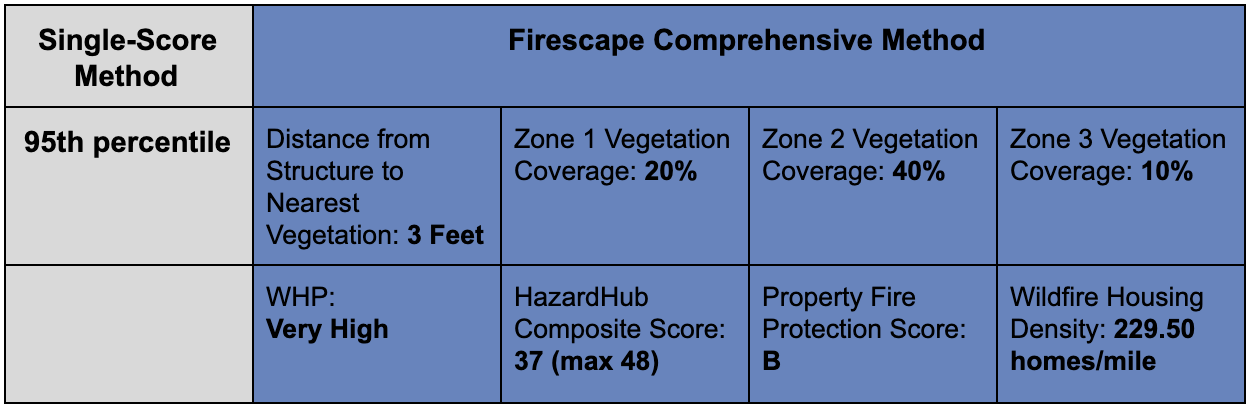

This third property again has the same very high-risk score. This one has a moderate amount of vegetative coverage on the property and borders an area of chaparral. Unlike the other two properties, it is also much closer to other buildings, with a much higher housing density, according to HazardHub. As we have learned from wildfires like the 2017 Tubbs Fire, which impact the neighborhoods of Fountaingrove and Coffey Park in Santa Rosa, CA, nearby buildings can be an additional ignition source and should not be counted as “non-burnable,” especially if they too border high-risk wildland.

The advantages of taking a comprehensive approach to wildfire risk assessment is clear. With the continued rise of the WUI, suburban sprawl, and warming environmental conditions, a single score method is no longer enough. A comprehensive method also empowers homeowners, allowing them to take measures to protect themselves and be rewarded for employing mitigation practices via credits or other incentives. Like vaccinations, as more homeowners take advantage of such incentives and firescape their properties, the overall risk across any adjoining communities will also lessen. Such measures have worked well in Montecito, in particular during the 2017 Thomas Fire, and other Southern California communities during major events.

As Cape’s comprehensive approach is rolled out by more carriers, we’ll continue to develop new property-specific features, beyond defensible space, that give carriers additional insight into risk and allow better segmentation of areas that are also in wildfire-prone regions. In the future, these capabilities will include attributes like the presence of a wood deck, identification of propane tanks, and woodpiles. In addition, we will begin rolling in new sources of high-resolution imagery, such as satellite, in order to bolster coverage in high-risk but extremely rural areas.