Introducing CAPE Hail Intelligence

Carriers Have a Hail Problem

As we discussed in our last hail blog post, the insurance industry sustains billions of dollars in hail losses each year, with one event earlier in 2021 costing over $1B alone. Over the last two decades, built areas and sprawl across the Midwest have increased by over 50 percent, leading to large increases in potential claims. Over that time, the industry focus shifted from understanding risky zip codes likely to experience hail, to broad-brush statistical analysis of areas that experience hail claims. These approaches lead to a misunderstanding of exposure, as the likelihood of an event or a claim in the area fails to identify the drivers of claims and the expected costs.

A lack of granular risk assessment solutions, built specifically for hail, has led many in the industry to see it as an intractable peril.

But novel technology solutions provide a new avenue into understanding this growing risk. A full assessment of hail risk includes calculating the likelihood of a hail event, the likelihood of damage being sustained, and the cost of that damage. The missing link in this chain is the vulnerability of specific homes or buildings to hail, and completing this puzzle leads to three substantial benefits:

- Improved pricing and rate segmentation, refined by identifying homes more prone to costly hail claims.

- Better exposure management with accurate identification of the roof elements, like complexity, that drive replacement costs and damage.

- The avoidance of paying for pre-existing damage by capturing roof condition issues and susceptibility to hail impact at the beginning of your new business workflow.

By pairing this new knowledge with more commonly available hail probability data, carriers can improve their loss ratio by pricing risk more accurately. However, gaining an understanding of property-specific vulnerability needs to be automated and near real time— consistent with modern quoting and underwriting workflows, and not dependent on physical inspections.

CAPE Hail Vulnerability Rating

CAPE Analytics’ breakthrough Hail Intelligence solution allows carriers to understand their true hail risk at the address level.

The CAPE Hail Vulnerability Rating provides property-level susceptibility to hail damage by leveraging specific structure characteristics that drive hail claim severity and frequency, and packages them into an easy-to-use vulnerability score.

A previous post explored the relationship between roof characteristics like complexity and size on hail claim severity and frequency. The Hail Vulnerability Rating looks at those and additional key, predictive drivers of hail risk.

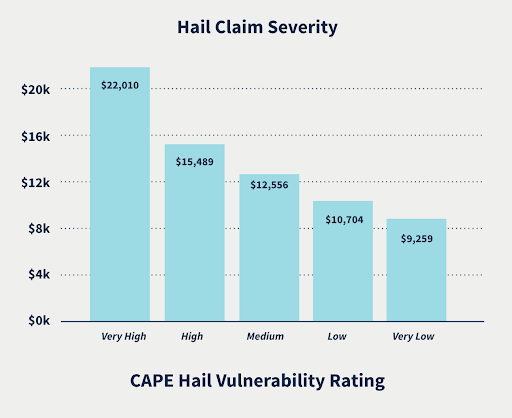

These merged signals create a score that performs better than the sum of its parts. CAPE Hail Intelligence also provides the inputs needed to calculate an appropriate replacement cost for a more accurate understanding of exposure. These roof vulnerability characteristics are highly predictive of the real-world experience of the severity and frequency of hail claims. The chart below shows the average hail claim severity as a function of the CAPE Hail Vulnerability Rating, demonstrating significant segmentation of risk within hail-prone areas.

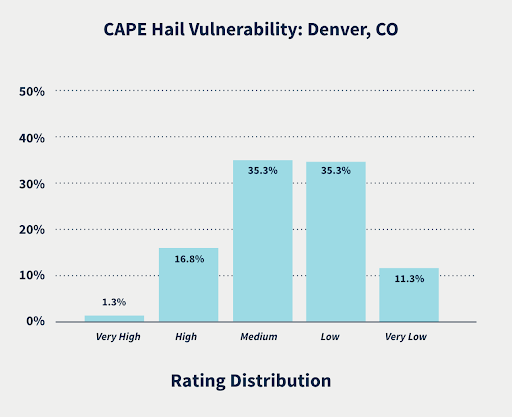

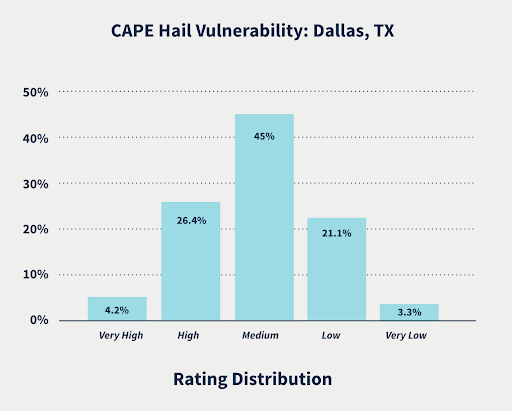

Structure vulnerability has many components that are separate from the likelihood of a hail event. In two very hail-prone areas, Dallas and Denver, the exposure can be very different — most likely due to different types of home construction.

As shown below, in Dallas, a very high percentage of homes have high to medium vulnerability — possibly due to the prevalence of large and highly complex roofs. Denver, on the other hand, is dominated by homes that range from medium to low vulnerability, with a far larger percentage characterized as very low risk.

Hail-related insurance losses are large and growing. Until now, carriers have relied on broad hazard information, weak proxies for vulnerability like roof age, and post-event weather information. Using new forms of property intelligence, CAPE helps carriers get more granular in their understanding of hail risk for every property within their book of business. Carriers can improve pricing, reduce the need for inspections, and avoid inheriting another carrier’s hail claims when writing new business.

The CAPE Hail Vulnerability Score identifies the underlying drivers of hail claims and blends them into an easy-to-use score that plugs into personal lines workflows. Hail is a major peril costing billions of dollars annually. Carriers can now apply better segmentation and exposure management by understanding the true risk. More transparent pricing will reduce loss ratios leading to a more robust and resilient insurance industry.

For a customized look into the vulnerability of your book of business in hail areas, contact us today.

The statistics in this post were derived by applying CAPE AI to imagery from Nearmap and other providers.